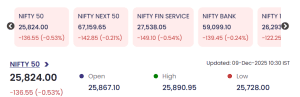

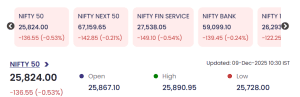

The Indian equity market opened on a subdued note on 9 December 2025, with the Nifty 50 declining 136.55 points (–0.53%) to 25,824.00 as of 10:30 AM IST.

While headline indices traded lower amid cautious global cues, selective buying was visible in micro- and small-cap counters, which helped offset broader weakness.

Market Snapshot: Index Performance

-

Nifty 50: 25,824.00 (–136.55 / –0.53%)

-

Open: 25,867.10

-

High: 25,890.95

-

Low: 25,728.00

-

Nifty Next 50: –0.21%

-

Nifty Financial Services: –0.54%

-

Nifty Bank: –0.24%

The sentiment remained cautious as investors awaited global economic signals and domestic inflation data.

Top Gainers: Small-Cap Stocks Outperform with Double-Digit Rallies

A handful of small-cap and low-float stocks attracted strong investor interest, posting impressive intraday gains:

| SYMBOL | LTP | CHNG | %CHNG | VOLUME (Lakhs) | VALUE (₹ Cr) |

|---|---|---|---|---|---|

| SCPL | 221.20 | +27.10 | +13.96% | 0.93 | 2.02 |

| INCREDIBLE | 43.05 | +4.97 | +13.05% | 1.94 | 0.85 |

| REPL | 136.45 | +12.41 | +10.00% | 0.80 | 1.09 |

| AURIGROW | 0.67 | +0.06 | +9.84% | 276.95 | 1.80 |

| ALPSINDUS | 2.38 | +0.21 | +9.68% | 0.62 | 0.01 |

Key Observations

-

SCPL led the gainers with a near 14% jump driven by strong investor accumulation.

-

Aurigrow witnessed extremely high trading volumes (276 lakh shares), indicating heavy retail participation despite its low price band.

-

REPL and Incredible maintained momentum with double-digit percentage gains, reflecting bullish sentiment in niche small-cap counters.

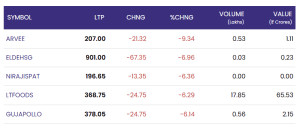

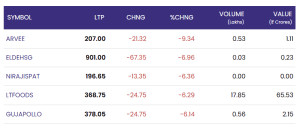

Top Losers: Mid-Cap and Micro-Cap Stocks Witness Sharp Declines

Weakness continued in select mid-cap stocks, with several names experiencing notable declines:

| SYMBOL | LPT | CHNG | %CHNG | VOLUME (Lakhs) | VALUE (₹ Cr) |

|---|---|---|---|---|---|

| ARVEE | 207.00 | –21.32 | –9.34% | 0.53 | 1.11 |

| ELDEHSG | 901.00 | –67.35 | –6.96% | 0.03 | 0.23 |

| NIRAJISPAT | 196.65 | –13.35 | –6.36% | 0.00 | 0.00 |

| LTFOODS | 368.75 | –24.75 | –6.29% | 17.85 | 65.53 |

| GUJAPOLLO | 378.05 | –24.75 | –6.14% | 0.56 | 2.15 |

Key Observations

-

Arvee Industries saw the steepest decline of the session, falling over 9%, extending its recent weakness.

-

LT Foods dropped sharply despite high trading value (₹65.53 crore), suggesting institutional selling.

-

Ultra-low volume declines in Eldehsg and Niraj Ispat reflect cautious sentiment in selective mid-cap segments.

Conclusion: 9 December 2025

The market on 9 December 2025 reflected a continuation of the cautious tone seen throughout the week. While benchmark indices traded lower due to global uncertainties and domestic macroeconomic expectations, selective strength in small-cap stocks demonstrated persistent bottom-up interest among investors.

Analysts expect short-term volatility to persist, with key triggers likely to emerge from global policy cues, domestic inflation readings, and institutional flow data.