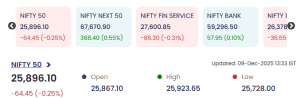

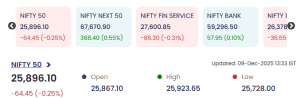

The Indian stock market witnessed a mildly negative trend during mid-session on 9 December 2025, with the Nifty 50 trading at 25,896.10, down 64.45 points (–0.25%) as of 13:33 IST. While benchmark indices remained subdued, the broader market showed resilience, with the Nifty Next 50 gaining 0.55%, indicating selective strength in mid- and small-cap segments.

Market Snapshot: Index Performance

-

Nifty 50: 25,896.10 (–64.45 / –0.25%)

-

Open: 25,867.10

-

High: 25,923.65

-

Low: 25,728.00

-

Nifty Next 50: +0.55%

-

Nifty Financial Services: –0.31%

-

Nifty Bank: +0.10%

The divergence in indices suggests sectoral rotation and selective institutional positioning.

Top Gainers: Small- and Mid-Cap Stocks Surge with Strong Buying Momentum

A cluster of small-cap counters outperformed the market, registering robust double-digit intraday gains:

| SYMBOL | LTP | CHNG | %CHNG | VOLUME (Lakhs) | VALUE (₹ Cr) |

|---|---|---|---|---|---|

| ADVENTHTL | 227.75 | +30.97 | +15.74% | 47.99 | 106.87 |

| SCPL | 222.55 | +28.45 | +14.66% | 1.53 | 3.36 |

| TTML | 51.62 | +5.97 | +13.08% | 568.95 | 286.41 |

| DOLATALGO | 84.24 | +9.26 | +12.35% | 159.80 | 130.51 |

| SOLARA | 615.80 | +65.50 | +11.90% | 24.21 | 146.33 |

Key Observations

-

ADVENTHTL topped the gainers with a 15.74% surge, driven by strong volume and renewed investor interest.

-

TTML witnessed massive activity, with trading volumes surpassing 568 lakh shares, indicating heightened retail and speculative interest.

-

Solara Active Pharma gained nearly 12%, supported by strong delivery-based buying.

-

Dolat Algo and SCPL recorded double-digit jumps, reflecting positive sentiment in selective small-cap pockets.

Top Losers: Correction Continues in Mid-Cap and Specialty Counters

A handful of stocks saw notable declines due to profit booking and sector-specific weakness:

| SYMBOL | LTP | CHNG | %CHNG | VOLUME (Lakhs) | VALUE (₹ Cr) |

|---|---|---|---|---|---|

| ARVEE | 202.00 | –26.32 | –11.53% | 0.87 | 1.79 |

| INDOWIND | 15.00 | –0.95 | –5.96% | 16.75 | 2.54 |

| ELDEHSG | 911.10 | –57.25 | –5.91% | 0.05 | 0.45 |

| GUJAPOLLO | 382.00 | –20.80 | –5.16% | 0.69 | 2.68 |

| TEAMGTY | 296.00 | –16.00 | –5.13% | 0.16 | 0.46 |

Key Observations

-

Arvee Industries saw the steepest decline, falling over 11%, extending its bearish trend from recent sessions.

-

Indowind Energy and Gujarat Apollo registered moderate declines amid low-to-medium volume trading.

-

Team Global Logistics slipped over 5%, reflecting cooling sentiment in logistics and supply chain-related counters.

-

Eldeco Housing (ELDEHSG) continued to correct after recent gains, signaling profit booking.

Conclusion: 9 December 2025

The market on 9 December 2025 reflected a mixed intraday sentiment, with benchmark indices edging lower while select small- and mid-cap names staged strong rallies.

The divergence across indices indicates ongoing sector rotation and cautious institutional positioning ahead of key macroeconomic announcements.

Analysts expect short-term volatility to persist but highlight opportunities emerging in niche sectors showing consistent accumulation.