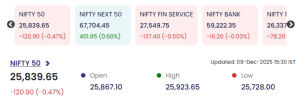

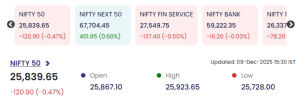

The Indian stock market witnessed continued volatility on 9 December 2025, with the Nifty 50 declining 120.90 points (–0.47%) to close at 25,839.65 by 15:30 IST. While frontline indices faced selling pressure, the broader market saw selective strength, especially in micro-cap and mid-cap counters, helping balance overall market sentiment.

Market Snapshot: Index Performance

-

Nifty 50: 25,839.65 (–120.90 / –0.47%)

-

Open: 25,867.10

-

High: 25,923.65

-

Low: 25,728.00

-

Nifty Next 50: +0.60%

-

Nifty Financial Services: –0.50%

-

Nifty Bank: –0.03%

The divergence highlights ongoing sector rotation and selective buying in broader market spaces.

Top Gainers: Broad-Based Momentum in Small-Cap Stocks

A strong rally was observed among select small-cap stocks, many of which recorded double-digit percentage gains backed by heavy trading volumes:

| SYMBOL | LTP | CHNG | %CHNG | VOLUME (Lakhs) | VALUE (₹ Cr) |

|---|---|---|---|---|---|

| RKEC | 54.97 | +9.16 | +20.00% | 6.68 | 3.44 |

| ADVENTHTL | 236.13 | +39.35 | +20.00% | 73.55 | 166.15 |

| TTML | 52.70 | +7.05 | +15.44% | 1,151.99 | 597.19 |

| ASHIMASYN | 19.30 | +2.58 | +15.43% | 5.69 | 1.05 |

| DOLATALGO | 86.00 | +11.02 | +14.70% | 224.30 | 184.71 |

Key Observations

-

RKEC and Advent International Hotels (ADVENTHTL) both hit 20% upper circuits, demonstrating strong investor appetite.

-

TTML stood out with extraordinary volume activity of 1,151 lakh shares, translating into nearly ₹600 crore in value—indicating widespread retail and speculative participation.

-

Dolat Algo and Ashima Syntex recorded steady gains driven by sustained market momentum in low-to-mid-tier counters.

Top Losers: Profit Booking Weighs on Select Mid-Cap Stocks

Several mid-cap and specialty counters faced sharp declines due to profit booking and sectoral weakness:

| SYMBOL | LTP | CHNG | %CHNG | VOLUME (Lakhs) | VALUE (₹ Cr) |

|---|---|---|---|---|---|

| ARVEE | 201.55 | –26.77 | –11.72% | 1.26 | 2.58 |

| ARENTERP | 46.45 | –3.74 | –7.45% | 0.03 | 0.01 |

| GSS | 17.99 | –1.37 | –7.08% | 2.21 | 0.40 |

| ELDEHSG | 903.00 | –65.35 | –6.75% | 0.06 | 0.51 |

| TEAMGTY | 292.00 | –20.00 | –6.41% | 0.21 | 0.62 |

Key Observations

-

Arvee Industries continued its downward trajectory, dropping nearly 12%, extending prior session losses.

-

Team Global Logistics (TEAMGTY) and Eldeco Housing (ELDEHSG) saw notable declines as investors booked profits following recent rallies.

-

Weak trading volumes in ARENTERP and GSS reflected cautious sentiment among small-cap investors.

Conclusion: 9 December 2025

The market on 9 December 2025 showcased a mixed risk environment. While benchmark indices drifted lower due to sectoral weakness and global uncertainty, small-cap stocks displayed strong resilience, with several hitting upper circuits and witnessing heightened trading activity.

Analysts expect volatility to persist in the short term, with opportunities emerging in selective small- and mid-cap counters that continue to attract institutional and retail interest.