Mumbai:

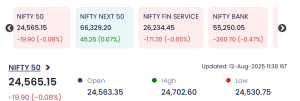

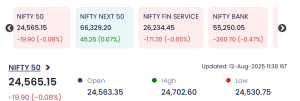

| Index | Value | Change | % Change |

|---|---|---|---|

| NIFTY 50 | 24,565.15 | -19.90 | -0.08% |

| NIFTY NEXT 50 | 66,329.20 | +45.25 | +0.07% |

| NIFTY FIN SERVICE | 26,234.45 | -171.35 | -0.65% |

| NIFTY BANK | 55,250.05 | -260.70 | -0.47% |

Financial and banking stocks underperformed amid volatile trading, while select next-50 stocks showed resilience.

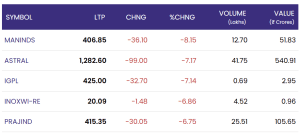

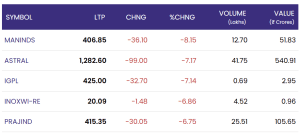

Top Losers: Significant Declines in MANINDS, ASTRAL, IGPL

-

MANINDS fell 8.15% to ₹406.85, with meaningful volume indicating strong profit-taking.

-

ASTRAL declined 7.17% to ₹1,282.60, among the highest value drops for the day.

-

IGPL, INOXWI-RE, and PRAJIND also posted losses above 6%, amid subdued sector sentiment.

| Symbol | Last Price | Change | % Change | Volume (Lakhs) | Value (₹ Crores) |

|---|---|---|---|---|---|

| MANINDS | 406.85 | -36.10 | -8.15% | 12.70 | 51.83 |

| ASTRAL | 1,282.60 | -99.00 | -7.17% | 41.75 | 540.91 |

| IGPL | 425.00 | -32.70 | -7.14% | 0.69 | 2.95 |

| INOXWI-RE | 20.09 | -1.48 | -6.86% | 4.52 | 0.96 |

| PRAJIND | 415.35 | -30.05 | -6.75% | 25.51 | 105.65 |

The bulk of selling activity appears concentrated in mid-cap counters, triggered by sector rotation and short-term profit booking.

Top Gainers: NDLVENTURE, WSI, INDIANCARD, GANDHITUBE Rally

-

NDLVENTURE surged 19.99%, closing at ₹85.06.

-

WSI matched the momentum, also up 19.99% at ₹86.26.

-

INDIANCARD, PRAXIS-RE2, and GANDHITUBE rounded off the top performers with gains above 13%.

| Symbol | Last Price | Change | % Change | Volume (Lakhs) | Value (₹ Crores) |

|---|---|---|---|---|---|

| NDLVENTURE | 85.06 | +14.17 | +19.99% | 2.69 | 2.27 |

| WSI | 86.26 | +14.37 | +19.99% | 2.35 | 1.90 |

| INDIANCARD | 308.60 | +42.30 | +15.88% | 1.35 | 4.19 |

| PRAXIS-RE2 | 0.15 | +0.02 | +15.38% | 4.46 | 0.01 |

| GANDHITUBE | 789.05 | +96.70 | +13.97% | 1.55 | 12.39 |

Robust volume and healthy value accumulation indicate active interest from investors in these counters, especially in sectors benefiting from emerging growth trends.

Sectoral Mood: Divergence and Profit Rotation on August 12

The session highlighted a clear divergence:

-

Financials and banks traded lower on selective selling.

-

Broader market remained resilient, with gains among next-50 and small-cap stocks.

Investors continue to rotate capital between sectors and capitalize on stock-specific opportunities. The underlying tone remains cautiously optimistic, but volatility persists due to international cues and domestic earnings season.

Conclusion: Mixed Cues, Stock-Specific Action Prevails

The equity market on August 12, 2025, reflected a tug-of-war between bulls and bears. Nifty 50 maintained levels above 24,500 despite minor losses, as sectoral underperformance in financials and banks was offset by sharp gains in select mid and small caps. Volatility remains a key theme, urging retailers and institutions to adopt tactical positioning and nimble analytics for sustained returns.