New Delhi: In a reflection of subdued investor sentiment and cautious global cues, gold prices experienced a marginal decline today across major Indian metropolitan cities, including Delhi, Mumbai, and Kolkata. Market analysts attribute the shift to easing international bullion demand, subtle dollar strengthening, and restrained retail consumption ahead of expected policy updates from the U.S. Federal Reserve.

Also Read: April 30 Indian Markets End Flat as Nifty 50 Holds Ground; Broader Indices Show Mixed Trends

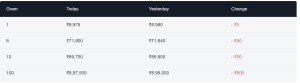

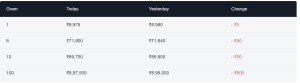

Delhi Market Update: Subtle Decline Across All Segments

The cost of 8 grams dropped from ₹71,840 to ₹71,800, while 10 grams declined from ₹89,800 to ₹89,750. The 100-gram category, which often reflects bulk buying and institutional trends, dropped significantly by ₹500, now priced at ₹8,97,500 from ₹8,98,000 the previous day.

This uniform reduction in rates suggests a strategic pause in demand ahead of expected macroeconomic indicators and a possible recalibration of prices based on international cues. Bullion traders in Delhi anticipate price stability with minor volatility in the coming week.

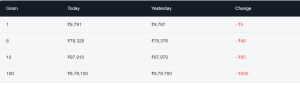

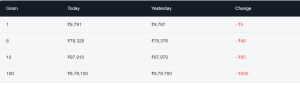

Mumbai Bullion Market: Higher Base Price, Similar Decline

The price for 1 gram of gold dropped from ₹9,797 to ₹9,791, a ₹6 decline. The 8-gram rate now stands at ₹78,328, down by ₹48 from yesterday’s ₹78,376. The 10-gram price has slipped to ₹97,910, while 100 grams are currently priced at ₹9,79,100, reflecting a ₹600 fall from the previous rate of ₹9,79,700.

Industry insiders suggest that Mumbai’s gold market pricing is partly influenced by its proximity to import hubs and greater integration with international pricing mechanisms. Despite the slight dip, premium rates in Mumbai persist due to high liquidity and refined quality demand.

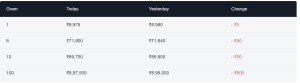

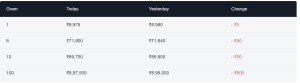

Kolkata Sees Conservative Movement in Prices

Kolkata, another key player in India’s gold consumption map, reported a more conservative correction in gold prices. The 1-gram price dropped by ₹4, from ₹7,348 to ₹7,344, while 8 grams fell by ₹32 to ₹58,752.

For 10 grams, the rate now stands at ₹73,440—₹40 less than the previous ₹73,480. Bulk prices followed the same trend, with the 100-gram rate declining by ₹400, from ₹7,34,800 to ₹7,34,400.

Experts suggest that demand in Eastern India typically mirrors wedding season trends and local festival calendars. With Akshaya Tritiya and other auspicious buying windows approaching, slight corrections may drive consumer interest.

Global Factors and Market Implications

Domestically, factors such as rupee fluctuation, import duty expectations, and seasonal consumer demand will continue to influence gold price dynamics in the short term.

Outlook: Buying Opportunity or Caution Zone?

With key festivals on the horizon and international indicators due this week, gold prices are likely to remain range-bound with a slight upward bias if demand returns. Buyers are advised to monitor spot prices and official hallmarking rates for accurate assessments.

For real-time updates on gold and silver prices, visit the official website of the National Stock Exchange (NSE).