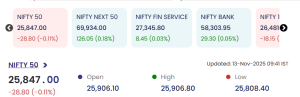

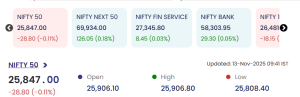

The Indian stock market began the session on 13 November 2025 with mild losses, as the Nifty 50 slipped 28.80 points or 0.11%. Despite the downbeat tone among large-cap names, active trading in microcap and smallcap stocks resulted in notable gains and sector rotation. Early action revealed mixed sentiment, with investors deploying fresh capital into select winners while booking profits in higher-flying counters.

Nifty 50 Trades Soft, Broader Indices Mixed

Microcap Surge: Univcables, Khandse, Precwire, SVPglob, Vindhyatel Top Gainers

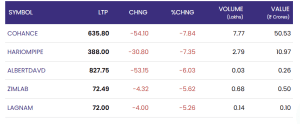

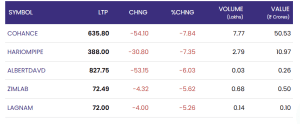

Key Losers: Cohance, Hariompip, Albertdavd Under Pressure

Volume and Value Analysis Signals Selective Participation

Market volume data saw moderate activity in Precwire (16.88 lakhs), Cohance (7.77 lakhs), and Hariompip (2.79 lakhs). Key value leaders included Cohance for the losers and Precwire, Univcables among gainers. The contrast between smallcap activity and large-cap softness highlights an environment favorable for rotational trading and short-term strategies.

Conclusion: 13 November 2025 (Opening)

13 November 2025’s opening session reflected cautious optimism, as benchmark indices pulled back slightly but microcap and smallcap names continued to attract fresh interest. Active trading in select sectors and stocks illustrated a healthy appetite for rotation, even as major indices consolidated. Investors’ focus on identifying niche opportunities in smaller companies remains a hallmark of current market conditions.

For real time stock Updates, visit NSE website.