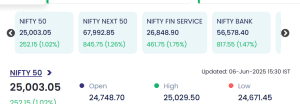

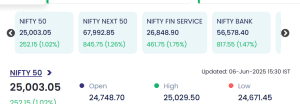

Mumbai: The Indian stock markets concluded on a buoyant note today, June 6, 2025, with all major indices witnessing a strong upward surge. The benchmark Nifty 50 breached the 25,000 milestone for the first time, closing at 25,003.05, a rise of 252.15 points or 1.02%. The overall market sentiment remained bullish throughout the session, driven by strong buying in banking, financial services, and midcap stocks.

📈 Major Index Performances on June 6 2025

| Index | Closing Value | Change (Points) | Change (%) |

|---|---|---|---|

| Nifty 50 | 25,003.05 | +252.15 | +1.02% |

| Nifty Next 50 | 67,992.85 | +845.75 | +1.26% |

| Nifty Fin Service | 26,848.90 | +461.75 | +1.75% |

| Nifty Bank | 56,578.40 | +817.55 | +1.47% |

📊 Day’s Trading Range (Nifty 50):

-

Open: 24,748.70

-

High: 25,029.50

-

Low: 24,671.45

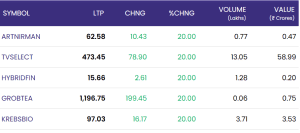

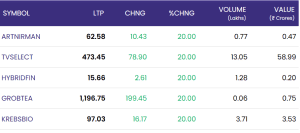

🚀 Top 5 Gainers (Upper Circuit Stocks – 20% Gain)

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| GROBTEA | 1,196.75 | +199.45 | 20.00% | 0.06 | 0.75 |

| TVSELECT | 473.45 | +78.90 | 20.00% | 13.05 | 58.99 |

| KREBSBIO | 97.03 | +16.17 | 20.00% | 3.71 | 3.53 |

| ARTNIRMAN | 62.58 | +10.43 | 20.00% | 0.77 | 0.47 |

| HYBRIDFIN | 15.66 | +2.61 | 20.00% | 1.28 | 0.20 |

These companies hit their upper circuit limits, gaining 20% each, and saw increased interest from investors, especially in sectors like tea production, bio-pharmaceuticals, and infrastructure.

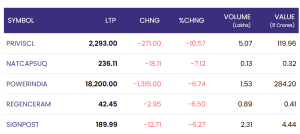

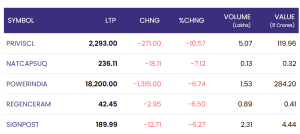

📉 Top 5 Losers of the Day

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| POWERINDIA | 18,200.00 | -1,315.00 | -6.74% | 1.53 | 284.20 |

| PRIVISCL | 2,293.00 | -271.00 | -10.57% | 5.07 | 119.96 |

| NATCAPSUQ | 236.11 | -18.11 | -7.12% | 0.13 | 0.32 |

| REGENCERAM | 42.45 | -2.95 | -6.50% | 0.89 | 0.41 |

| SIGNPOST | 189.99 | -12.71 | -6.27% | 2.31 | 4.44 |

Despite the overall positive trend, a few stocks faced strong selling pressure, particularly in the capital goods and ceramic sectors.

💡 Market Outlook and Sentiment

Investor confidence seems bolstered by positive macroeconomic indicators, improving corporate earnings, and foreign institutional investor (FII) inflows. The strong performance by financial services and banking stocks suggests optimism about India’s economic momentum and credit cycle recovery.

With Nifty 50 now above the psychological 25,000 mark, analysts are watching closely for sustainability of this uptrend, with focus shifting to the upcoming RBI monetary policy announcement and global cues.

✅ Conclusion

The Indian equity market displayed robust strength today, led by strong gains across frontline indices and broad-based participation from sectors like finance, banking, and consumer discretionary. While a few stocks saw declines, the broader trend remained firmly positive, signaling continued investor optimism and growing market depth.

For real time stock Updates, visit NSE website.