Mumbai: The Indian equity markets opened the week on a cautious yet optimistic note, navigating global uncertainties and mixed economic signals to end Tuesday’s trading session in green. On April 22, 2025, the Nifty 50 and Sensex showed modest gains, primarily driven by strong performance in the banking and financial sectors, while investor sentiment remained buoyed by positive domestic earnings expectations and firm institutional support.

While global markets exhibited a range-bound behavior amid ongoing concerns over crude oil volatility and US Fed commentary, Indian markets demonstrated resilience. Institutional buying, especially in frontline banking stocks, and active participation from retail investors in small-cap counters helped the broader market maintain a positive undertone.

Today’s market behavior reflects a cautious confidence among investors, with key indices like the Nifty Bank and Nifty Financial Services outperforming their broader counterparts, reinforcing India’s status as a relatively stable investment destination amid global flux.

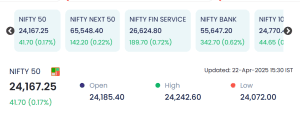

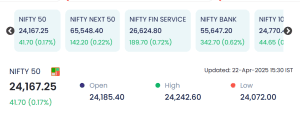

Major Index Performance

| Index Name | Closing Value | Absolute Change | % Change |

|---|---|---|---|

| NIFTY 50 | 24,167.25 | +41.70 | +0.17% |

| NIFTY NEXT 50 | 65,548.40 | +142.20 | +0.22% |

| NIFTY 100 | 24,770.40 | +44.65 | +0.18% |

| NIFTY FIN SERVICE | 26,624.80 | +189.70 | +0.72% |

| NIFTY BANK | 55,647.20 | +342.70 | +0.62% |

-

Open: 24,185.40

-

High: 24,242.60

-

Low: 24,072.00

-

Close: 24,167.25

-

Previous Close: 24,125.55

-

Updated: 22-Apr-2025 15:30 IST

💹 Sectoral Outlook

-

Top Gainers:

-

Financial Services (+0.72%)

-

Banking (+0.62%)

-

Insurance and NBFCs witnessed strong buying, driven by better-than-expected Q4 results.

-

-

Flat/Negative:

-

IT and Pharma sectors showed muted performance, tracking mixed global cues and profit booking.

-

📈 Top Gainers on April 22 – NSE (20% Upper Circuits & Strong Volumes)

| Stock | LTP (₹) | Change (%) | Volume (Lakh) | Value (Cr) | Trigger |

|---|---|---|---|---|---|

| RAJRATAN | 390.15 | +19.99% | 8.10 | 30.13 | Reversal from support; technical breakout |

| AGRITECH | 172.89 | +20.00% | 1.04 | 1.71 | Bullish agri-sector outlook |

| MANAKSTEEL | 60.18 | +20.00% | 18.11 | 10.79 | Positive corporate commentary |

| COUNCODOS | 7.56 | +20.00% | 11.26 | 0.81 | Micro-cap buying interest |

| KOHINOOR | 43.21 | +19.99% | 6.27 | 2.55 | Strong delivery buying |

🔍 Note: These scrips hit their upper circuit limits, suggesting high investor confidence and buying pressure.

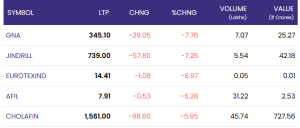

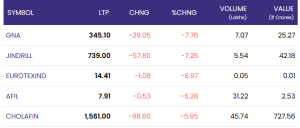

📉 Top Losers on April 22 – Profit Booking in Mid-Caps

| Stock | LTP (₹) | Change (%) | Volume (Lakh) | Value (Cr) | Possible Reason |

|---|---|---|---|---|---|

| CHOLAFIN | 1,561.00 | -5.95% | 45.74 | 727.56 | Profit booking post Q4 results |

| JINDRILL | 739.00 | -7.25% | 5.54 | 42.18 | Weak volume expansion |

| GNA | 345.10 | -7.76% | 7.07 | 25.27 | Sectoral underperformance |

| EUROTEXIND | 14.41 | -6.97% | 0.05 | 0.01 | Low liquidity |

| AFIL | 7.91 | -6.28% | 31.22 | 2.53 | Retail selling pressure |

📊 Market Breadth & Technical Sentiment

-

Advances outpaced declines on the NSE, indicating a healthy breadth.

-

Volatility Index (India VIX) remained under 13, suggesting market stability.

-

Strong supports held at Nifty 24,050 levels, while resistance was tested near 24,250.

🧠 Key Institutional Activity

-

Foreign Institutional Investors (FIIs): Net buyers, with inflows seen in banking and consumer durable stocks.

-

Domestic Institutional Investors (DIIs): Continued support in the broader markets, focusing on mid- and small-caps.

📅 Global Market Influence

-

US markets opened flat ahead of upcoming macroeconomic data.

-

Crude oil remained volatile, slightly above $88/barrel, influencing Indian energy stocks.

-

Rupee traded stable at 83.12 vs USD.

🔮 Outlook for 23 April 2025

-

Market Tone: Neutral to positive

-

Key Levels to Watch:

-

Nifty Support: 24,050 – 24,000

-

Nifty Resistance: 24,300 – 24,375

-

-

Traders may focus on:

-

Upcoming corporate earnings (Q4FY25)

-

RBI MPC member speeches

-

Global geopolitical news and oil data

-

📌 Expert Commentary

“Markets are showing resilience despite global headwinds. If financials continue to lead, we may see fresh all-time highs on Nifty Bank soon.”

— Ramesh Bhatia, Technical Analyst, GrowTrade India

✅ Conclusion

As the markets closed with marginal gains on April 22, 2025, investor attention has now shifted to upcoming quarterly earnings results, key policy statements, and global macroeconomic cues that could influence short-term movements. The positive action in financial and mid-cap stocks signals a healthy appetite for risk among domestic investors, while the low volatility index (VIX) indicates steady hands in the market.

While the headline indices traded in a tight range, sector-specific activity and stock-specific momentum continued to create profitable opportunities for discerning traders. With the Nifty hovering around the 24,200 mark, traders and analysts alike remain watchful of any breakout beyond the 24,300 resistance or a correction below the 24,050 support.

In the near term, markets may continue to consolidate gains unless fresh global cues or domestic triggers induce a directional breakout. For long-term investors, this phase offers a chance to accumulate quality stocks selectively, particularly in banking, insurance, and consumption-related sectors.

For more stock updates check on NSE website.