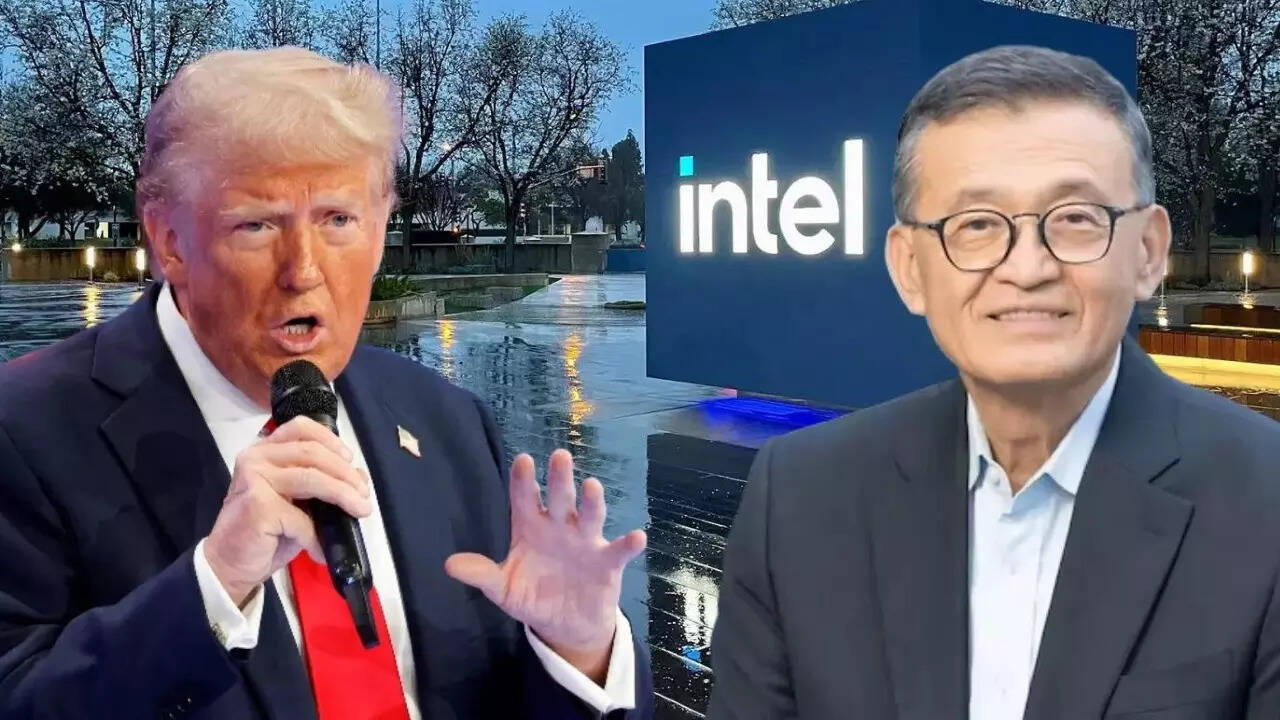

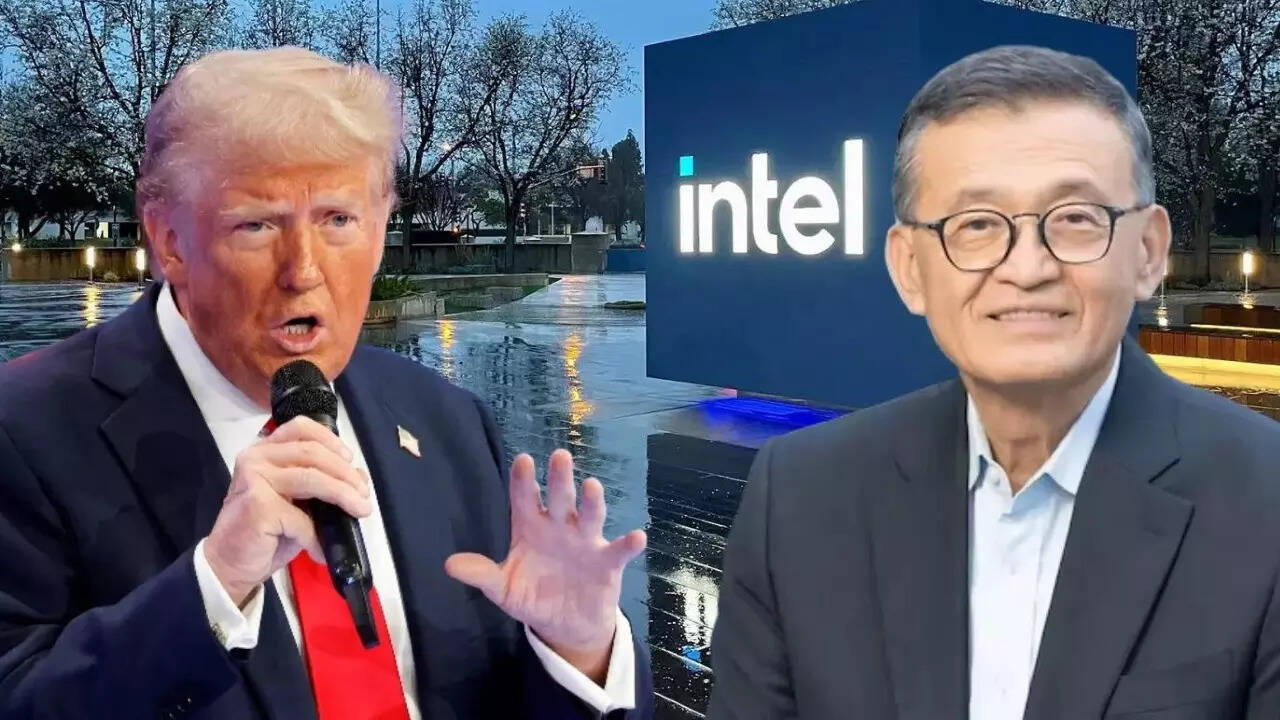

Shares of Intel plummeted after former President Donald Trump publicly demanded the resignation of CEO Lip‑Bu Tan, calling him “highly conflicted” due to alleged financial ties with Chinese tech companies, including those with connections to the Chinese military. The controversy erupted on Trump’s Truth Social platform and quickly escalated after Senator Tom Cotton warned Intel’s board of Tan’s past investments in sensitive Chinese firms. The market reacted swiftly, with Intel stock falling over 3% in pre-market trading and trading volumes spiking as investor concerns about national security and corporate governance grew rapidly.

The demand for Lip-Bu Tan’s resignation has rapidly rattled investor confidence not just in Intel, but across the broader semiconductor supply chain. Suppliers, OEM partners, and industrial buyers may now hesitate in placing long-term orders with Intel, fearing political volatility. Trust in executive leadership is critical when chips are essential to defense, automotive, and infrastructure sectors. Weakness in top-level stability inherently risks delaying contracts and strategic engagements.

This latest upheaval at Intel underscores a wider trend in Silicon Valley—leadership turnover is now frequently driven by political crosswinds, not just operational performance issues. Previously, Intel had ousted CEO Pat Gelsinger amid multi-billion-dollar losses and missed milestones. Now, external pressure appears equally capable of triggering executive exits, highlighting how geopolitics and governance are reshaping executive accountability.

Tan’s extensive investments in Chinese tech firms, including those with ties to the Chinese military, have now moved from latent concerns to headline-grabbing controversy. Questions about national security and safeguarding U.S. taxpayer‑funded infrastructure have surged. Intel’s role in the CHIPS Act and its defense-related production has placed the company at the intersection of private enterprise and national strategy—a delicate balance now under siege.

Even before the resignation demand, Wall Street was already wary of Intel’s profitability outlook. The company’s delayed foundry expansions, mounting losses, and market-share decline to rivals like AMD and Nvidia were all red flags. The political backlash only compounds these structural challenges. Investors now demand clarity on how governance turmoil will impact Intel’s ability to execute its operational turnaround.

Intel’s $8 billion subsidy under the U.S. CHIPS Act is contingent on trust and strategic alignment. With leadership under political scrutiny, the company’s government-backed factory expansion plans—such as the Ohio mega-fab—may face delays or additional oversight. Lawmakers could reevaluate compliance standards, divert funds, or delay approvals pending assurance of robust governance protocols.

The leadership crisis puts Intel’s board directly under public and shareholder scrutiny. Questions arise: Did they properly vet Tan’s investment ties? Was conflict-of-interest management sufficient? If they misjudged or failed to heed past warnings, the board’s oversight credibility could suffer long-term damage, potentially triggering internal governance reform or shareholder activism.

Stock Drop Adds to Intel’s Ongoing Struggles

This controversy comes on the heels of existing challenges at Intel. The company has been struggling with competitive setbacks in the AI chipmaking arena, a shrinking market share, and significant delays in building advanced fabrication facilities. The ongoing leadership turbulence now adds further pressure to Intel’s attempts at revival. The company was already under the microscope for its ability to responsibly manage an $8 billion subsidy from the U.S. CHIPS Act, and the political storm over Tan’s links to Chinese tech threatens to derail those efforts and reduce confidence in Intel’s long-term trajectory.

As the fallout continues, industry observers are closely tracking how international partners respond. Intel’s collaborations with European and Asian governments, particularly for fab investments in Germany and Israel, may face fresh scrutiny. Political turbulence in U.S. leadership can influence foreign confidence, prompting delays in project approvals or funding. Such repercussions may ripple across Intel’s global roadmap, disrupting its carefully orchestrated revival strategy.

In the semiconductor race, trust and predictability are as vital as technological prowess. With the U.S. government positioning Intel as a linchpin of domestic chip independence, any leadership scandal undermines that mission. Competitors like Taiwan’s TSMC or South Korea’s Samsung could exploit this moment of weakness to strengthen their diplomatic and industrial relationships with key global economies—thereby recalibrating the power balance in chip manufacturing.

There is growing concern among policy experts that Tan’s case may serve as a precedent for future politicization of executive leadership in American tech firms. While corporate governance traditionally remained an internal matter, recent moves suggest an evolving doctrine where national interests directly influence boardroom decisions. This trend could erode corporate independence, increase compliance burdens, and expose executives to politically motivated attacks.

Internally, Intel is also confronting pressure from advocacy groups and watchdogs demanding increased transparency around board decisions and conflict-of-interest disclosures. These calls have intensified amid revelations that certain investments were under review months ago but never publicly addressed. Activist shareholders are preparing to demand reforms, including stronger oversight mechanisms and tighter executive eligibility standards rooted in national security ethics.

Meanwhile, competitors like Nvidia and AMD continue to surge ahead in AI and GPU dominance. Intel, already playing catch-up, may find itself further sidelined if internal disarray derails its timelines. Missing another product cycle or delaying crucial launches could result in permanent market share loss, especially as the AI-driven demand for high-performance chips explodes globally.

The tech sector at large is also watching closely to see how the federal government manages its relationship with Intel post-crisis. A misstep in optics or punitive overreaction could chill corporate enthusiasm for public-private partnerships, precisely at a time when domestic semiconductor capacity is a strategic priority. Balancing accountability with continuity will be key for regulators to avoid sending a discouraging signal to innovators.

For now, analysts recommend caution, noting that despite short-term pain, Intel still holds significant long-term value if it can stabilize leadership and continue executing its foundry strategy. The company’s manufacturing footprint, intellectual property, and role in the global chip ecosystem remain unmatched by many. However, the next few weeks will be pivotal in determining whether Intel remains a cornerstone of America’s tech infrastructure or becomes a cautionary tale of political interference.

Questions of Governance and National Security

The demand for Tan’s resignation has amplified concerns about potential foreign influence in one of America’s most strategically critical industries. As the only U.S.-based company capable of advanced semiconductor fabrication, Intel is central to national tech infrastructure and the CHIPS Act’s vision for American tech independence. Critics now question whether the current leadership can safeguard national interests and maintain the trust of both the government and the public. The unfolding controversy may further complicate Intel’s negotiations and its credibility in policy circles.

Market analysts anticipate continued volatility ahead. With uncertainty over executive leadership, strategic direction, and regulatory response, Intel shares may oscillate sharply. Support levels near $18.50, previously identified by technical analysts, could be tested if confidence erodes further. Investors may remain cautious until a clear resolution or transition plan emerges.

A leadership crisis doesn’t just rattle the markets—it affects Intel’s internal environment. Workforce morale may dip, especially amid ongoing layoffs and restructuring. Key talent may begin exploring options elsewhere, questioning job security amid executive instability. Retention efforts and internal communication will need to strengthen, or Intel risks hemorrhaging its most critical human capital.

Intel’s situation illustrates a broader shift in how global tech leaders are evaluated—not solely on performance, but also on geopolitical alignment. Multinational executives with international holdings may now face heightened scrutiny. The case may deter cross-border investment or hiring decisions, reshaping leadership dynamics across the industry, and raising the bar for risk management.

Ultimately, Intel’s path will hinge on its response. A transparent, accountable board process, accompanied by rapid, credible communication, could restore confidence. Alternatively, failure to address these governance and security concerns effectively may deepen the crisis, trigger regulatory probes, or even disrupt the company’s access to critical federal programs. For Intel, the immediate future demands clarity, not just nimble execution, as much as principled leadership.

Investor Sentiment: Cautiously Bearish

Even before Trump’s call for resignation, Wall Street had become wary of Intel’s prospects. Analysts had noted declining demand, restructuring hurdles, and the lack of clear execution under Tan’s leadership. The fresh political heat has only intensified investor doubts. There’s a growing belief that without immediate executive clarity and stronger oversight, Intel might struggle to stabilize its valuation and retain institutional support. The board’s response in the coming days could determine whether the company recovers investor confidence or slides further into market skepticism.

Looking Ahead: Uncertainty and Executive Oversight

As of now, Intel has not issued a public response to the demands for Tan’s resignation. The silence is seen by many as damaging, as investors and stakeholders look for signs of strong corporate governance. The situation places the board under intense scrutiny—both in terms of their prior due diligence and their future decisions. With rising geopolitical tensions, especially in the tech sector, the pressure on Intel to clarify its leadership path, restore confidence, and ensure transparency will only grow. How it handles this moment could shape the company’s fate for years to come.

Follow: Intel

Also read: Home | Channel 6 Network – Latest News, Breaking Updates: Politics, Business, Tech & More