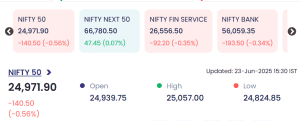

Mumbai: Indian equities ended in the red on 23 June 2025, weighed down by heightened global uncertainty and weak cues from oil and financial sectors. The benchmark Nifty 50 closed at 24,971.90, down 140.50 points or 0.56%, slipping below the 25,000 mark.

-

Opening: 24,939.75

-

Day’s High: 25,057.00

-

Day’s Low: 24,824.85

Sectors such as financial services, banking, and frontline stocks faced selling pressure, while select small and mid-cap stocks defied broader weakness to post sharp gains.

🧾 Sector Snapshot on 23 June 2025

| Index | Closing Level | Change | % Change |

|---|---|---|---|

| Nifty 50 | 24,971.90 | -140.50 | -0.56% |

| Nifty Next 50 | 66,780.50 | +47.45 | +0.07% |

| Nifty Fin Service | 26,556.50 | -92.20 | -0.35% |

| Nifty Bank | 56,059.35 | -193.50 | -0.34% |

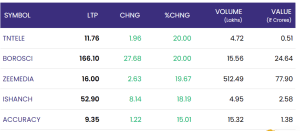

🚀 Top Gainers of the Day

| Symbol | LTP | Change | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| TNTELE | 11.76 | +1.96 | +20.00% | 4.72 | 0.51 |

| BOROSCI | 166.10 | +27.68 | +20.00% | 15.56 | 24.64 |

| ZEEMEDIA | 16.00 | +2.63 | +19.67% | 512.49 | 77.90 |

| ISHANCH | 52.90 | +8.14 | +18.19% | 4.95 | 2.58 |

| ACCURACY | 9.35 | +1.22 | +15.01% | 15.32 | 1.38 |

Noteworthy:

-

ZEEMEDIA witnessed extraordinary volumes with over 512 lakh shares traded, indicating heightened investor interest.

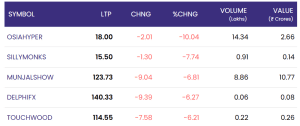

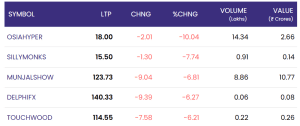

📉 Top Losers of the Day

| Symbol | LTP | Change | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| OSIAHYPER | 18.00 | -2.01 | -10.04% | 14.34 | 2.66 |

| SILLYMONKS | 15.50 | -1.30 | -7.74% | 0.91 | 0.14 |

| MUNJALSHOW | 123.73 | -9.04 | -6.81% | 8.86 | 10.77 |

| DELPHIFX | 140.33 | -9.39 | -6.27% | 0.06 | 0.08 |

| TOUCHWOOD | 114.55 | -7.58 | -6.21% | 0.22 | 0.26 |

📈 Market Insight: What’s Driving the Sentiment?

The day’s sell-off is attributed to:

-

Rising geopolitical tensions in West Asia, leading to a spike in global crude oil prices

-

Profit booking in financial and banking sectors

-

Weak global cues and caution ahead of key macroeconomic announcements

At the same time, broader interest in media, specialty chemicals, and manufacturing-related counters kept investor interest alive in select segments.

✅ Conclusion: Volatility Expected to Continue

The sharp divergence between benchmark indices and select small-cap gainers indicates a stock-specific market environment, with volatility expected to persist. Traders are advised to stay cautious as global uncertainty, coupled with monsoon-related macro risks, continues to weigh on sentiment.

As Nifty hovers near a psychological threshold, investors will closely monitor cues from global markets, oil prices, and FII flows in the coming sessions.

For real time stock Updates, visit NSE website.