Mumbai, May 16, 2025: Indian equity benchmarks traded mixed in the early session on Thursday, with the Nifty 50 registering a marginal decline amid cautious investor sentiment. The broader market, however, remained resilient, led by strong gains in select mid- and small-cap counters. Despite weakness in financial and banking stocks, investors showed optimism in undervalued or turnaround companies, reflected in sharp gains across non-index names.

Also Read: May 14: Nifty Surges Slightly Amid Mixed Sectoral Trends; Small Caps Show Strong Momentum

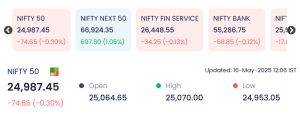

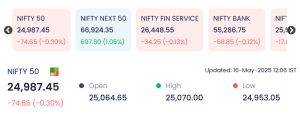

📊 Nifty Index Performance on May 16

Other key indices showed mixed trends:

-

Nifty Next 50 surged by 697.80 points (1.05%) to 66,924.35, buoyed by strong midcap stock movement.

-

Nifty Financial Services declined 0.13% to 26,448.55, while

-

Nifty Bank slipped 0.12% to 55,286.75.

🔼 Top 5 Gainers (Mid-Session)

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr.) |

|---|---|---|---|---|---|

| PKTEA | 785.60 | 130.90 | 19.99% | 0.12 | 0.93 |

| ZEELEARN | 7.87 | 1.31 | 19.97% | 42.90 | 3.28 |

| KARMAENG | 67.45 | 9.63 | 16.66% | 0.34 | 0.20 |

| WANBURY | 318.85 | 41.29 | 14.88% | 19.80 | 62.94 |

| BEARDSELL | 32.51 | 4.12 | 14.51% | 8.59 | 2.85 |

Analysis:

-

PKTEA saw a near 20% spike, likely driven by renewed investor interest in FMCG-related agri stocks or a speculative upswing.

-

ZEELEARN traded with exceptionally high volume, suggesting retail and institutional participation possibly anticipating restructuring or acquisition-related news.

-

WANBURY, a pharma counter, saw renewed buying backed by strong volumes and institutional activity.

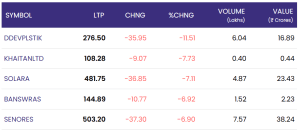

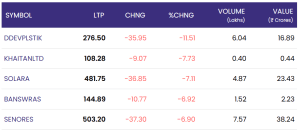

🔻 Top 5 Losers (Mid-Session)

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr.) |

|---|---|---|---|---|---|

| DDEVPLSTIK | 276.50 | -35.95 | -11.51% | 6.04 | 16.89 |

| KHAITANLTD | 108.28 | -9.07 | -7.73% | 0.40 | 0.44 |

| SOLARA | 481.75 | -36.85 | -7.11% | 4.87 | 23.43 |

| BANSWRAS | 144.89 | -10.77 | -6.92% | 1.52 | 2.23 |

| SENORES | 503.20 | -37.30 | -6.90% | 7.57 | 38.24 |

Analysis:

-

DDEVPLSTIK led the losers, possibly reacting to disappointing earnings or large-volume selling.

-

Solara and Senores, both from the pharmaceutical space, faced sell-offs, potentially due to regulatory overhangs or weak guidance.

-

Declines in Khaitan Ltd. and Banswara Syntex further reflect sector-specific corrections and profit booking.

📈 Market Outlook & Investor Sentiment

The Indian market’s mixed behavior highlights ongoing volatility in the face of global uncertainties, inflation-related concerns, and interest rate speculation. Investors are becoming increasingly stock-specific, favoring value picks and turnaround stories in the broader market. Sectors like FMCG, pharma, and niche manufacturing continue to attract attention.

While the headline Nifty index faced mild selling, the rally in midcap counters reflects confidence among domestic investors and funds in India’s underlying growth story.

✅ Conclusion

Despite a negative close for the Nifty 50, the strong uptrend in the midcap space — led by names like PKTEA, WANBURY, and ZEELEARN — signals ongoing stock-specific opportunities in the Indian equity market. The underperformance of large financials and pharma counters may offer short-term headwinds, but underlying domestic participation remains encouraging. Investors are advised to remain cautious yet optimistic, focusing on earnings visibility and strong fundamentals for sustained gains.

For real time stock Updates, visit NSE website.