Mumbai: As trading resumed after the mid-week break, the Indian stock markets opened with strong momentum on Thursday, 2 May 2025, reflecting robust investor confidence across segments. Global cues remained relatively stable, while domestic sentiment received a boost from encouraging corporate earnings, easing inflation expectations, and continued interest from institutional investors. The NIFTY 50 surged past the 24,450 mark, registering a solid intraday rally in early hours of trade. With midcap and small-cap stocks leading the charge, market participants are seeing a broad-based uptrend—signaling a healthy appetite for risk amid improving macroeconomic indicators.

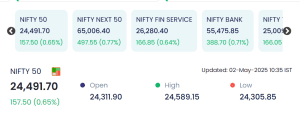

Market Overview on May 2

📊 Sectoral Indices Performance

All key indices were in the green, showing a broad-based rally across market segments:

-

NIFTY NEXT 50: 65,006.40 (+497.55 / +0.77%)

Mid-tier companies saw renewed interest, especially in FMCG and textiles. -

NIFTY FINANCIAL SERVICES: 26,280.40 (+166.85 / +0.64%)

Driven by private sector banks and NBFCs, financial services continued to gain as bond yields remained steady. -

NIFTY BANK: 55,475.85 (+388.70 / +0.71%)

Strong performance from PSU banks and ICICI Bank boosted the index. -

NIFTY MIDCAP SELECT: 25,009.85 (+166.05 / +0.67%)

Midcaps outperformed, indicating increased retail and institutional interest.

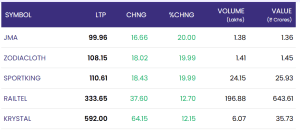

🟢 Top Gainers – Small & Midcap Rally in Focus

Below are the top 5 gaining stocks in terms of percentage increase as of 10:35 AM:

| Symbol | Last Traded Price (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| JMA | 99.96 | +16.66 | +20.00% | 1.38 | 1.36 |

| ZODIACLOTH | 108.15 | +18.02 | +19.99% | 1.41 | 1.45 |

| SPORTKING | 110.61 | +18.43 | +19.99% | 24.15 | 25.93 |

| RAILTEL | 333.65 | +37.60 | +12.70% | 196.88 | 643.61 |

| KRYSTAL | 592.00 | +64.15 | +12.15% | 6.07 | 35.73 |

-

RAILTEL: The stock witnessed a sharp rally backed by very high volume (196.88 lakh shares) and value turnover of ₹643.61 crore—suggesting strong institutional buying, possibly driven by government digital infrastructure pushes.

-

SPORTKING and ZODIACLOTH showed strong technical breakouts, gaining nearly 20% each, likely due to sectoral rotation into textiles and manufacturing.

-

KRYSTAL‘s rise may be driven by an earnings surprise or a recent contract win in facility management services.

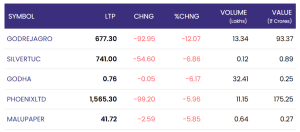

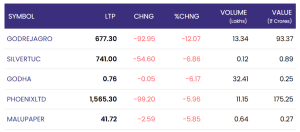

🔻 Top Losers – Weakness in Agro and Specialty Stocks

| Symbol | Last Traded Price (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| GODREJAGRO | 677.30 | -92.95 | -12.07% | 13.34 | 93.37 |

| SILVERTUC | 741.00 | -54.60 | -6.86% | 0.12 | 0.89 |

| GODHA | 0.76 | -0.05 | -6.17% | 32.41 | 0.25 |

| PHOENIXLTD | 1,565.30 | -99.20 | -5.96% | 11.15 | 175.25 |

| MALUPAPER | 41.72 | -2.59 | -5.85% | 0.64 | 0.27 |

-

GODREJAGRO took the biggest hit, sliding over 12% likely due to below-expectation quarterly results or a downgrade by a major brokerage.

-

PHOENIXLTD’s decline, despite high traded value (₹175.25 Cr), points toward profit booking post a recent rally or a negative trigger such as regulatory news.

-

GODHA and MALUPAPER saw losses amid low investor confidence, possibly impacted by sector-specific risks.

📌 Key Market Highlights

-

Market breadth is clearly positive, with gainers outpacing losers.

-

Midcaps are outperforming large caps—indicating strong retail participation.

-

RAILTEL’s surge may have a long-term institutional support basis, ideal for monitoring.

-

GODREJAGRO’s steep fall could invite bottom fishing if supported by technical indicators later in the day.

📈 Outlook for the Day

Traders are advised to remain cautiously optimistic. Global cues remain neutral, and Indian equities are currently driven by domestic earnings, sectoral strength, and policy tailwinds. Watch out for volatility in the second half, especially around currency movement and US jobless data due later tonight.

Conclusion:

As of mid-morning on 2 May 2025, the Indian equity markets are witnessing a positive and broad-based rally, backed by strength in banking, midcap, and financial services sectors. The sharp upmoves in certain counters, especially in textiles and infrastructure, highlight a sectoral rotation that investors and analysts are actively tracking. At the same time, the correction in stocks like GODREJAGRO and PHOENIXLTD serves as a reminder that stock-specific news and earnings disappointment can still lead to significant intraday volatility.

Going forward, markets are expected to remain buoyant in the short term, especially if macroeconomic data continues to support the current risk-on sentiment. However, traders should stay alert to global events—especially US employment data and oil price movements—that could affect investor mood. Overall, today’s early market behavior points toward an optimistic outlook for the trading session, with opportunities emerging in both frontline and mid-tier segments.

For real time stock updates, visit NSE Official Website.