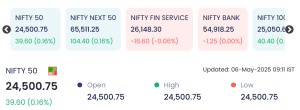

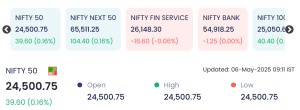

Mumbai: The Indian equity market opened on a cautiously optimistic note on Tuesday, May 6, 2025, with the Nifty 50 beginning trade at 24,500.75, registering a modest gain of 0.16%. This tepid yet positive start reflects mixed sentiments among investors as global markets grapple with uncertain macroeconomic signals while domestic corporate earnings continue to roll in.

Also Read: May 5, 2025: Nifty Climbs While Bank Stocks Stumble: Top Gainers & Losers

The broader indices mirrored this sentiment, with the Nifty Next 50, Nifty 100, and others maintaining a steady course. Notably, sectors such as IT, Midcaps, and FMCG showed early strength, whereas banking and financial services witnessed mild profit booking.

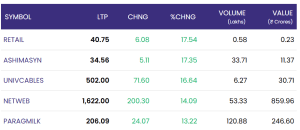

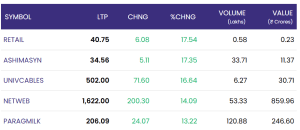

In the individual stock landscape, NETWEB, UNIVCABLES, and PARAGMILK emerged as top gainers, riding on robust volume and market buzz. On the downside, KSOLVES, VMART, and GTECJAINX experienced sharp intraday corrections, pulling back after previous rallies or due to market-specific triggers.

Nifty 50 Market Overview of May 6

| Index | Value | Change | % Change |

|---|---|---|---|

| NIFTY 50 | 24,500.75 | +39.60 | +0.16% |

| NIFTY NEXT 50 | 65,511.25 | +104.40 | +0.16% |

| NIFTY FIN SERVICE | 26,148.30 | -16.60 | -0.06% |

| NIFTY BANK | 54,918.25 | -1.25 | 0.00% |

| NIFTY 100 | 25,050.60 | +40.40 | +0.16% |

The market breadth remained positive, supported by gains in broader indices like the Nifty Next 50 and Nifty 100.

📈 Top Gainers on NSE

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| NETWEB | 1,622.00 | +200.30 | +14.09% | 53.33 | 859.96 |

| UNIVCABLES | 502.00 | +71.60 | +16.64% | 6.27 | 30.71 |

| PARAGMILK | 206.09 | +24.07 | +13.22% | 120.88 | 246.60 |

| RETAIL | 40.75 | +6.08 | +17.54% | 0.58 | 0.23 |

| ASHIMASYN | 34.56 | +5.11 | +17.35% | 33.71 | 11.37 |

Highlights:

-

NETWEB led the rally with significant buying interest and high volume.

-

UNIVCABLES followed with a strong 16.64% surge, supported by decent turnover.

-

PARAGMILK‘s double-digit gains hint at renewed investor confidence in the dairy sector.

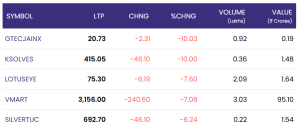

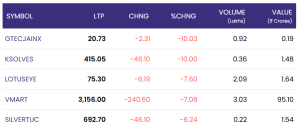

📉 Top Losers on NSE

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| KSOLVES | 415.05 | -46.10 | -10.00% | 0.36 | 1.48 |

| SILVERTUC | 692.70 | -46.10 | -6.24% | 0.22 | 1.54 |

| VMART | 3,156.00 | -240.60 | -7.08% | 3.03 | 95.10 |

| LOTUSEYE | 75.30 | -6.19 | -7.60% | 2.09 | 1.64 |

| GTECJAINX | 20.73 | -2.31 | -10.03% | 0.92 | 0.19 |

Observations:

-

KSOLVES and GTECJAINX saw sharp corrections, both falling around 10%.

-

VMART experienced a heavy ₹240 drop, likely due to profit booking or earnings-related volatility.

-

Overall, these declines were limited to select counters and didn’t drag broader indices significantly.

Market Sentiment & Sectoral Overview

Financial Services and Banking indices opened in red, reflecting minor caution in the BFSI sector, possibly due to mixed earnings reports and ongoing concerns around interest rate policies.

Meanwhile, IT, FMCG, and midcap stocks showed early signs of recovery, indicating a shift in investor preference toward sectors with stronger fundamentals and resilient margins amid global uncertainties.

Auto and Pharma stocks are witnessing selective buying, buoyed by expectations of stable demand and positive quarterly projections. On the other hand, realty and metal stocks remain under pressure, weighed down by valuation concerns and global commodity price fluctuations.

With the corporate earnings season in full swing, volatility is expected to remain high. Market participants are advised to stay stock-specific, focus on companies with robust earnings visibility, and keep a close watch on management commentary for forward-looking guidance.

📌 Conclusion

Today’s market tone is a classic case of stock-specific action driving index stability, with select midcap and thematic counters like NETWEB and UNIVCABLES enjoying strong momentum. The broader Nifty held steady despite banking and financial services offering no meaningful support.

With global inflation data, US Fed commentary, and Indian corporate earnings in focus, investors are advised to remain stock-specific, avoid herd sentiment, and manage risk proactively. Defensive plays in FMCG and IT might offer stability, while midcaps may provide short-term trading opportunities for those with high risk appetite.

As the trading day unfolds, maintaining a balanced approach between quality large-cap holdings and selective growth stories in mid and small caps could be the key to navigating current volatility.