Mumbai: Indian equity markets witnessed a broad-based correction on Friday, May 9, 2025, as key benchmark indices closed significantly lower, weighed down by heavy selling in the banking and financial services sector. The mood on Dalal Street remained cautious amid global macroeconomic uncertainties, mixed earnings results, and subdued risk appetite from institutional investors.

Also Read: 8 May 2025: Markets End Lower as Geopolitical Concerns Weigh Heavy; Nifty 50 Slides Below 24,300

Despite a promising open and brief positive momentum in early trade, indices reversed sharply, closing near day’s lows. While select mid-cap and speculative counters attracted intraday attention, the broader sentiment stayed firmly negative. Sectoral indices like Nifty Financial Services and Nifty Bank led the decline, confirming a risk-off environment.

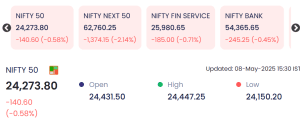

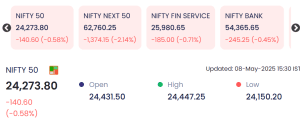

📊 Key Indices Snapshot on May 9

| Index | Closing | Change (Pts) | % Change | Market View |

|---|---|---|---|---|

| NIFTY 50 | 24,008.00 | -265.80 | -1.10% | Strong Sell-off |

| NIFTY NEXT 50 | 62,527.00 | -233.25 | -0.37% | Mild Weakness |

| NIFTY FIN SERVICE | 25,502.10 | -478.55 | -1.84% | Sector Under Pressure |

| NIFTY BANK | 53,595.25 | -770.40 | -1.42% | Significant Weakness |

-

NIFTY 50 Open: 23,935.75

-

Day’s High: 24,164.25

-

Day’s Low: 23,935.75

📉 Trend: Profit booking and sectoral rotation dominated the trading day as frontline financial stocks saw consistent selling pressure.

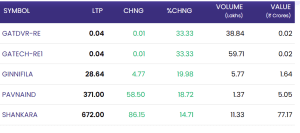

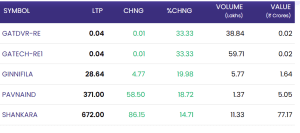

📈 Top Gainers of the Day

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Turnover (₹ Cr) |

|---|---|---|---|---|---|

| MAXIND-RE | 24.00 | +5.15 | +27.32% | 0.40 | 0.07 |

| GATDVR-RE | 0.05 | +0.01 | +25.00% | 10.36 | 0.01 |

| GATECH-RE1 | 0.05 | +0.01 | +25.00% | 280.14 | 0.14 |

| IDEA FORGE | 463.50 | +77.25 | +20.00% | 115.41 | 515.47 |

| PREMEXPLN | 477.50 | +75.90 | +18.90% | 57.07 | 260.91 |

💡 Noteworthy Observations:

-

MAXIND-RE led the gainers, driven by speculative interest in rights entitlements.

-

IDEA FORGE and PREMEXPLN showed bullish momentum with strong institutional demand and volume strength.

-

RE (Rights Entitlement) counters gained sharply, possibly in response to upcoming deadlines or corporate actions.

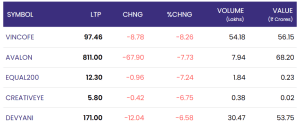

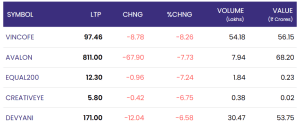

📉 Top Losers of the Day

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Turnover (₹ Cr) |

|---|---|---|---|---|---|

| MUTHOOTMF | 128.69 | -17.57 | -12.01% | 13.99 | 18.24 |

| AGIIL | 736.15 | -86.20 | -10.48% | 1.00 | 7.68 |

| GRINDWELL | 1,611.00 | -160.30 | -9.05% | 1.94 | 32.02 |

| JMA | 86.40 | -8.02 | -8.49% | 0.87 | 0.78 |

| ACEINTEG | 22.25 | -1.74 | -7.25% | 0.09 | 0.02 |

🔻 Key Insights:

-

MUTHOOTMF suffered steep losses, potentially on weak earnings or guidance.

-

GRINDWELL and AGIIL experienced sharp corrections despite relatively stable volumes, hinting at sector-specific weakness.

-

Low-cap counters like ACEINTEG saw sell-offs on thin volumes, highlighting risk aversion in illiquid scrips.

✅ Conclusion: Pressure Across the Board, But Pockets of Opportunity Remain

The Indian stock market ended the week on a bearish note, reflecting widespread concern among investors. Heavyweights in banking and finance bore the brunt of selling, pulling down benchmark indices despite resilience in a few mid-cap names. Market breadth remained negative, and volumes suggested a risk-off mood among both retail and institutional participants.

However, stocks such as IDEA FORGE and PREMEXPLN indicated that select opportunities still exist for discerning investors. Going forward, traders will be watching global interest rate commentary, domestic macro indicators, and corporate earnings for directional cues.

📝 Investor Outlook: Caution is advised in the near term. Focus on fundamentally strong stocks, avoid over-leveraging, and keep an eye on volatility triggers both domestically and globally.

For real-time updates and verified data, visit the NSE India official website