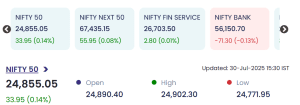

Mumbai, July 30, 2025 — Indian equity benchmarks ended the day on a positive note, with the Nifty 50 closing at 24,855.05, up 33.95 points or 0.14%. The index traded in a narrow range, recording an intraday high of 24,902.30 and a low of 24,771.95. The market opened at 24,890.40.

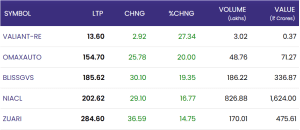

Top Gainers

| Stock | LTP | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| Zuari Agro | ₹284.60 | +₹36.59 | +14.75% | 170.01 | ₹475.61 |

| NIACL (New India Assurance) | ₹202.62 | +₹29.10 | +16.77% | 826.88 | ₹1,624.00 |

| Bliss GVS Pharma | ₹185.62 | +₹30.10 | +19.35% | 186.22 | ₹336.87 |

| Omax Autos | ₹154.70 | +₹25.78 | +20.00% | 48.76 | ₹71.27 |

| Valiant Organics (RE) | ₹13.60 | +₹2.92 | +27.34% | 3.02 | ₹0.37 |

Zuari Agro Chemicals Ltd. surged over 14% on news of strong Q1 earnings and renewed fertilizer subsidy discussions. NIACL gained significantly amid reports of a potential capital infusion and robust premium growth. High trading volumes in these stocks signal renewed investor interest.

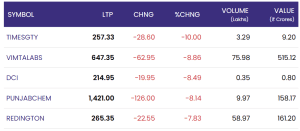

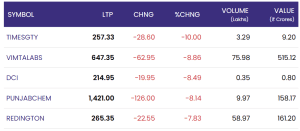

Top Losers

| Stock | LTP | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| Punjab Chemicals | ₹1,421.00 | -₹126.00 | -8.14% | 9.97 | ₹158.17 |

| Vimta Labs | ₹647.35 | -₹62.95 | -8.86% | 75.98 | ₹515.12 |

| DCI (Dredging Corp) | ₹214.95 | -₹19.95 | -8.49% | 0.35 | ₹0.80 |

| Redington India | ₹265.35 | -₹22.55 | -7.83% | 58.97 | ₹161.20 |

| Times Guaranty | ₹257.33 | -₹28.60 | -10.00% | 3.29 | ₹9.20 |

Among laggards, Punjab Chemicals and Vimta Labs saw a sharp sell-off due to profit booking and lack of fresh triggers. Times Guaranty and DCI also witnessed sharp corrections, likely influenced by weaker quarterly performance and muted guidance.

Market Sentiment and Outlook on July 30

The broader market was mixed, with midcap and smallcap stocks showing selective strength. According to market analysts, investors are awaiting cues from the upcoming U.S. Federal Reserve meeting, inflation trends, and domestic macro data, which will shape near-term sentiment.

“Nifty has shown resilience but is facing stiff resistance around the 24,900 level. Unless we break that decisively, consolidation may continue,” said A.K. Mishra, Head of Research at Axis Securities.

Despite modest gains, global volatility and FII flows remain key factors to watch. The RBI monetary policy meeting scheduled next week is expected to provide further direction.