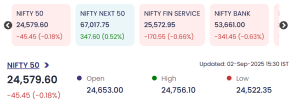

Mumbai: On 2 September 2025, the Indian stock market exhibited a cautious mood as the Nifty 50 index ended marginally lower, weighed down by profit-taking in financial and banking sectors. However, select mid-cap and small-cap stocks staged robust rallies, displaying a clear divergence in market performance. The trading session was marked by volatility and sector rotation ahead of important economic events.

Also Read: September 2, 2025 (Mid-cap): Nifty 50 and Major Indices Rise Amid Selective Buying

Market Summary on 2 September 2025

Key Gainers and Losers

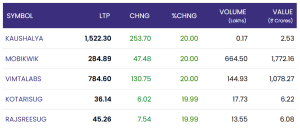

Amid the cautious trading atmosphere, some stocks delivered significant price movements. Below is a detailed table summarizing the top gainers and top losers of the day, highlighting their latest trading price, percentage change, volume traded, and total value.

Top Gainers

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Crores) |

|---|---|---|---|---|---|

| KAUSHALYA | 1,522.30 | 253.70 | 20.00% | 0.17 | 2.53 |

| MOBIKWIK | 284.89 | 47.48 | 20.00% | 664.50 | 1772.16 |

| VIMTALABS | 784.60 | 130.75 | 20.00% | 144.93 | 1078.27 |

| KOTARISUG | 36.14 | 6.02 | 19.99% | 17.73 | 6.22 |

| RAJSREESUG | 45.26 | 7.54 | 19.99% | 13.55 | 6.08 |

These stocks reflect strong buying interest, driven possibly by positive corporate developments or speculative momentum. Particularly, MobiKwik’s volume of 664.50 lakh shares stands out, indicating exceptional market activity.

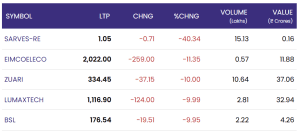

Top Losers

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Crores) |

|---|---|---|---|---|---|

| SARVES-RE | 1.05 | -0.71 | -40.34% | 15.13 | 0.16 |

| EIMCOELECO | 2,022.00 | -259.00 | -11.35% | 0.57 | 11.88 |

| ZUARI | 334.45 | -37.15 | -10.00% | 10.64 | 37.06 |

| LUMAXTECH | 1,116.90 | -124.00 | -9.99% | 2.81 | 32.94 |

| BSL | 176.54 | -19.51 | -9.95% | 2.22 | 4.26 |

The steep decline in Sarvesh-RE is noteworthy, as it posted a sharp 40.34% drop on relatively high volume. Other blue chips like EIMCOELECO, Zuari, and LumaxTech suffered notable losses reflecting cautious sentiment in select sectors.

Sectoral Outlook

Pressure in financials and banking weighed on the broader market, with both indices closing in the red. Nifty Financial Services and Nifty Bank fell 0.66% and 0.63%, respectively, as investors booked profits ahead of key monetary and policy announcements. Conversely, the Nifty Next 50’s 0.52% gain highlights selective buying interest beyond the core benchmark stocks.

Conclusion

The 2 September 2025 trading session captured the ongoing theme of market caution paired with selective optimism. While blue-chip and financial stocks faced selling pressure, an influx of demand in mid- and small-cap stocks like MobiKwik, Kaushalya, and Vimta Labs underlined pockets of investor confidence. As volatility remains elevated, a stock-specific approach may dominate trading strategies in the near term.

For real time stock Updates, visit NSE website.