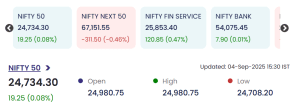

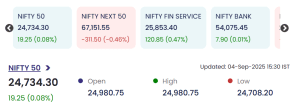

Mumbai: Indian equity benchmarks ended Thursday’s session, September 4, 2025 with modest gains, as the Nifty 50 inched up by 19.25 points (0.08%) amid selective strength in financials, autos, and technology names. While mid-cap action remained lively, profit booking emerged in several counters with high trade volumes.

Also Read: Nifty 50 Rises Marginally on 4 September 2025 (Midcap) ; GCSL, MOSCHIP Lead Gains, SARVES-RE Plunges

Market Overview on September 4

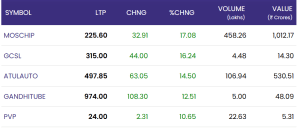

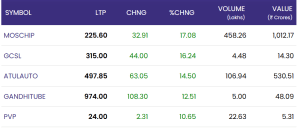

Top Gainers

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| MOSCHIP | 225.60 | 32.91 | 17.08% | 458.26 | 1,012.17 |

| GCSL | 315.00 | 44.00 | 16.24% | 4.48 | 14.30 |

| ATULAUTO | 497.85 | 63.05 | 14.50% | 106.94 | 530.51 |

| GANDHITUBE | 974.00 | 108.30 | 12.51% | 5.00 | 48.09 |

| PVP | 24.00 | 2.31 | 10.65% | 22.63 | 5.31 |

MOSCHIP soared over 17% on exceptional trading volume of 458 lakh shares, reflecting strong interest in technology sector stocks. ATULAUTO and GCSL also posted robust double-digit gains, powered by both volume and value flows.

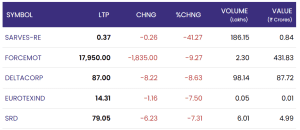

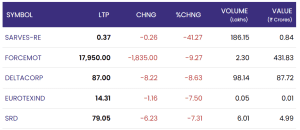

Top Losers

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| SARVES-RE | 0.37 | -0.26 | -41.27% | 186.15 | 0.84 |

| FORCEMOT | 17,950.00 | -1,835.00 | -9.27% | 2.30 | 431.83 |

| DELTACORP | 87.00 | -8.22 | -8.63% | 98.14 | 87.72 |

| EUROTEXIND | 14.31 | -1.16 | -7.50% | 0.05 | 0.01 |

| SRD | 79.05 | -6.23 | -7.31% | 6.01 | 4.99 |

SARVES-RE recorded a dramatic 41% decline on the back of a huge trading volume of 186 lakh shares, continuing its volatile streak. FORCEMOT also suffered a steep fall, losing 9%, along with persistent losses in DELTACORP and SRD.

Sectoral and Trade Trends

Financials supported the benchmark advance, while trade volume was unusually high in select technology and mid-cap names. Nifty Next 50’s sharp decline revealed risk aversion in certain segments, whereas robust turnover drove select gainers and high-profile losers.

Conclusion

On 4 September 2025, Indian markets posted a narrow advance, with MOSCHIP and GCSL leading gains and SARVES-RE and FORCEMOT under sharp pressure. The day’s action underscored selective optimism in tech and auto areas, set against substantial profit booking and volatility in mid-caps. Sectoral rotation and volume-driven opportunities remain key themes for near-term trades.

For real time stock Updates, visit NSE website.