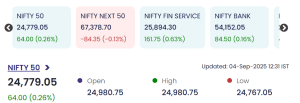

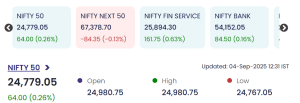

Mumbai: Indian equity markets saw a mild uptrend on 4 September 2025, with the Nifty 50 advancing 64 points (0.26%) amid sustained buying in select sectors and rotational stock activity. The session was marked by notable volume flows and strong performance in technology and auto stocks, while certain counters experienced steep declines.

Market Overview

Top Gainers and Losers

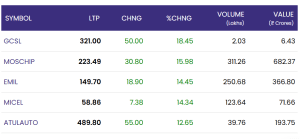

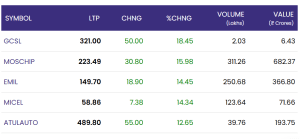

The trading session featured pronounced movements in mid-cap and technology stocks. Below are tables summarizing the day’s top gainers and losers by price, change, percentage move, traded volume, and transaction value.

Top Gainers

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| GCSL | 321.00 | 50.00 | 18.45% | 2.03 | 6.43 |

| MOSCHIP | 223.49 | 30.80 | 15.98% | 311.26 | 682.37 |

| EMIL | 149.70 | 18.90 | 14.45% | 250.68 | 366.80 |

| MICEL | 58.86 | 7.38 | 14.34% | 123.64 | 71.66 |

| ATULAUTO | 489.80 | 55.00 | 12.65% | 39.76 | 193.75 |

Strong gains in technology-focused stocks such as MOSCHIP (up nearly 16% on 311 lakh shares traded) and EMIL reflected heightened investor interest in the digital and electronics segment. ATULAUTO also saw robust gains, driven by market optimism in the auto sector.

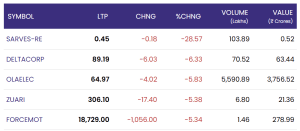

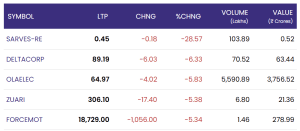

Top Losers

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| SARVES-RE | 0.45 | -0.18 | -28.57% | 103.89 | 0.52 |

| DELTACORP | 89.19 | -6.03 | -6.33% | 70.52 | 63.44 |

| OLAELEC | 64.97 | -4.02 | -5.83% | 5,590.89 | 3,756.52 |

| ZUARI | 306.10 | -17.40 | -5.38% | 6.80 | 21.36 |

| FORCEMOT | 18,729.00 | -1,056.00 | -5.34% | 1.46 | 278.99 |

SARVES-RE experienced a sharp 28.57% decline on large trading volume, continuing its recent volatility streak. Heavy selling in counters including DELTACORP and OLAELEC showed profit booking and sector rotation in select segments.

Sector Trends on 4 September 2025

Financials, banks, and select technology stocks led the positives during the session while underperformance in the Nifty Next 50 index signaled cautious optimism. A mix of high turnover and stock-specific momentum kept market action lively amid broader consolidation.

Conclusion

The Indian benchmarks continued their steady climb on 4 September 2025, as mid-cap and tech stocks posted outsized gains against isolated declines in counters like SARVES-RE. A blend of rotation out of underperforming stocks and strong flows into technology and auto names fueled positive sentiment, setting the tone for continued resilience in Indian equities.

For real time stock Updates, visit NSE website.