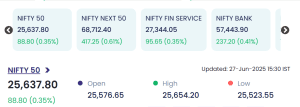

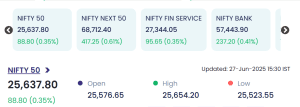

Mumbai: In a session marked by resilience and broad-based buying, the Indian equity markets ended on a positive note on Friday, 27 June 2025 . The Nifty 50 closed at 25,637.80, up by 88.80 points or 0.35%, signaling investor confidence despite mixed global cues. Strong gains in auto, financial services, and mid-cap counters pushed the benchmarks higher, while selective profit booking capped further gains.

📈 Key Index Performance on 27 June 2025

| Index | Value | Change | % Change |

|---|---|---|---|

| Nifty 50 | 25,637.80 | ▲ 88.80 | +0.35% |

| Nifty Next 50 | 68,712.40 | ▲ 417.25 | +0.61% |

| Nifty Fin Service | 27,344.05 | ▲ 95.65 | +0.35% |

| Nifty Bank | 57,443.90 | ▲ 237.20 | +0.41% |

-

Opening: 25,576.65

-

High: 25,654.20

-

Low: 25,523.55

The Nifty 50 index traded in a narrow band through the day but closed near the day’s high, suggesting strong buying at lower levels. The day also saw momentum in the Bank Nifty, which helped lift sentiment.

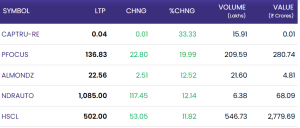

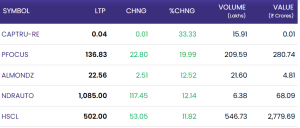

🔼 Top 5 Gainers: Stocks That Stole the Show

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| CAPTRU-RE | 0.04 | +0.01 | +33.33% | 15.91 | 0.01 |

| PFOCUS | 136.83 | +22.80 | +19.99% | 209.59 | 280.74 |

| ALMONDZ | 22.56 | +2.51 | +12.52% | 21.60 | 4.81 |

| NDRAUTO | 1,085.00 | +117.45 | +12.14% | 6.38 | 68.09 |

| HSCL | 502.00 | +53.05 | +11.82% | 546.73 | 2,779.69 |

-

HSCL (Hindustan Steelworks Construction Ltd.) was the star performer with exceptionally high volumes and value turnover, indicating institutional interest and technical breakout.

-

PFOCUS (Prime Focus Ltd.) surged nearly 20% amid buzz of a restructuring deal and optimism in the media-tech space.

-

NDRAUTO saw a strong rally on the back of robust delivery reports and increased market share in the EV segment.

🔻 Top 5 Losers: Stocks Facing the Heat

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| MEDICO | 39.67 | -9.33 | -19.04% | 36.23 | 15.35 |

| SUPREME | 81.17 | -10.50 | -11.45% | 3.84 | 3.16 |

| GATECHDVR | 0.90 | -0.10 | -10.00% | 408.15 | 3.96 |

| CONFIPET | 50.99 | -4.40 | -7.94% | 90.89 | 47.21 |

| NARMADA | 17.66 | -1.29 | -6.81% | 5.51 | 1.04 |

-

MEDICO declined sharply due to disappointing quarterly guidance and a recent downgrade by a brokerage firm.

-

SUPREME and CONFIPET saw profit booking after their recent rally and underperformed due to sector-specific weakness.

💬 Market Sentiment & Technical Take

The market breadth was largely positive, with the Nifty Midcap and Smallcap indices outperforming the benchmark. Technical indicators such as the Relative Strength Index (RSI) hovered in the neutral zone, suggesting further upside potential without being overbought.

With sustained buying in financials and selective midcaps, bulls continue to control market direction. However, analysts recommend caution as valuations remain stretched in some pockets.

🔍 What’s Driving the Market?

-

🔹 Strong domestic liquidity and continued participation from retail investors.

-

🔹 Resilient corporate earnings in key sectors like auto, banking, and IT.

-

🔹 Global cues were mixed with uncertainty over U.S. rate cuts and geopolitical tensions.

📌 Outlook for Next Week

-

Market participants will keenly track macro data such as GST collections, PMI numbers, and global inflation trends.

-

The upcoming Q1 earnings season will set the tone for sector-specific moves.

-

Volatility may rise due to F&O expiry, with heavyweights likely to dictate overall sentiment.

For real time stock Updates, visit NSE website.