The Indian stock market continued its upward trajectory in the afternoon session on October 23, 2025, led by notable gains in major indices and significant activity in select midcap stocks. Market sentiment remained buoyant, supported by robust volumes and broad-based participation across sectors.

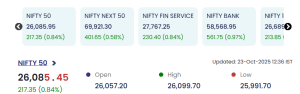

Nifty 50 Maintains Momentum

Top Gainers: Massive Volumes, Double-Digit Returns

| Symbol | LTP | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|

| EPACKPEB | 236.20 | 16.10% | 231.62 | 544.00 |

| COASTCORP | 44.80 | 19.98% | 34.01 | 15.17 |

| FCSSOFT | 2.53 | 19.91% | 397.72 | 9.90 |

| KITEX | 215.60 | 15.43% | 79.15 | 167.82 |

| BAGFILMS | 7.87 | 14.72% | 6.12 | 0.46 |

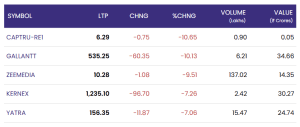

Notable Decliners: Profit Booking Visible

| Symbol | LTP | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|

| CAPTRU-RE1 | 6.29 | -10.65% | 0.90 | 0.05 |

| GALLANTT | 535.25 | -10.13% | 6.21 | 34.66 |

| ZEEMEDIA | 10.28 | -9.51% | 137.02 | 14.35 |

| KERNEX | 1,235.10 | -7.26% | 2.42 | 30.27 |

| YATRA | 156.35 | -7.06% | 15.47 | 24.74 |

Sectoral Focus and Trading Sentiment

The trading session underscored significant appetite for midcaps, driven by renewed retail and institutional flows. The high trading values in select names—especially EPACKPEB and KITEX—suggest targeted accumulation. Meanwhile, the sharp reversals in Gallantt and ZEEMEDIA point to ongoing volatility and sector-specific rotation, warranting a careful stock-picking approach in the coming days.

Conclusion: October 23, 2025 (Mid-cap)

On October 23, 2025, Indian equity benchmarks sustained their gains, boosted by strong momentum in key indices and a rally in select midcap stocks. While the majority of sectors participated in the rally, several counters saw notable corrections, highlighting the need for a balanced investment approach amid optimism and volatility.

For real time stock Updates, visit NSE website.