Q2 Results 2025 Reflect a Mixed Quarter for India Inc with Strong Profits and Marginal Declines

Q2 Results 2025 have revealed a dynamic picture of India’s corporate landscape, with several major companies posting strong profit growth while others witnessed a decline in margins. As the July–September quarter wrapped up, investors saw a clear divide between outperforming sectors like infrastructure, energy, and banking, and those facing challenges due to cost pressures and market fluctuations.

Adani Enterprises reported a significant 83% rise in quarterly profit despite a dip in revenue, underscoring the conglomerate’s focus on cost efficiency and portfolio diversification. Similarly, Adani Ports & SEZ Ltd. posted a 27.2% increase in net profit to ₹3,109 crore, with revenue surging nearly 30% to ₹9,167 crore. The company’s strong logistics operations and consistent port expansions have kept it at the forefront of India’s infrastructure growth story.

Q2 Results 2025 Reveal Growth in Banking, Energy, and Infrastructure Sectors Amid Market Volatility

Among the top performers, Suzlon Energy stood out with a remarkable sixfold jump in net profit to ₹1,279 crore, driven by robust demand in the renewable energy sector. The company’s revenue soared 84% to ₹3,872 crore, and EBITDA margin improved sharply, reflecting operational efficiency and a growing clean energy portfolio. Suzlon’s stock rose following the announcement, signaling renewed investor confidence in India’s wind energy revival.

Meanwhile, State Bank of India (SBI) showcased steady financial performance, reporting a 10% rise in net profit to ₹20,159 crore and a 3% increase in net interest income to ₹42,984 crore. The bank’s asset quality continued to improve, with gross NPA falling to 1.73% and net NPA at 0.42%. These results underline the strength of India’s banking sector, which remains resilient amid global economic uncertainty.

Q2 Results 2025 Highlight Adani, SBI, and Suzlon as Key Market Movers

In contrast, Escorts Kubota Ltd. reported strong revenue growth of 22.6% to ₹2,792 crore but saw its net profit dip 1.9% to ₹318 crore. The decline was attributed to rising input costs and fluctuating demand in the agricultural equipment market. Despite the fall in profits, the company’s EBITDA rose 56%, indicating underlying business stability.

Greenply Industries, one of India’s key plywood manufacturers, reported a 9% decline in net profit to ₹15.9 crore even though revenue rose by 7.5% to ₹689 crore. Margins were slightly impacted due to higher raw material prices and competitive pressures, reflecting the broader trend of squeezed profitability in the manufacturing sector.

Q2 Results 2025 Show Shifts in Corporate Performance Across Industries

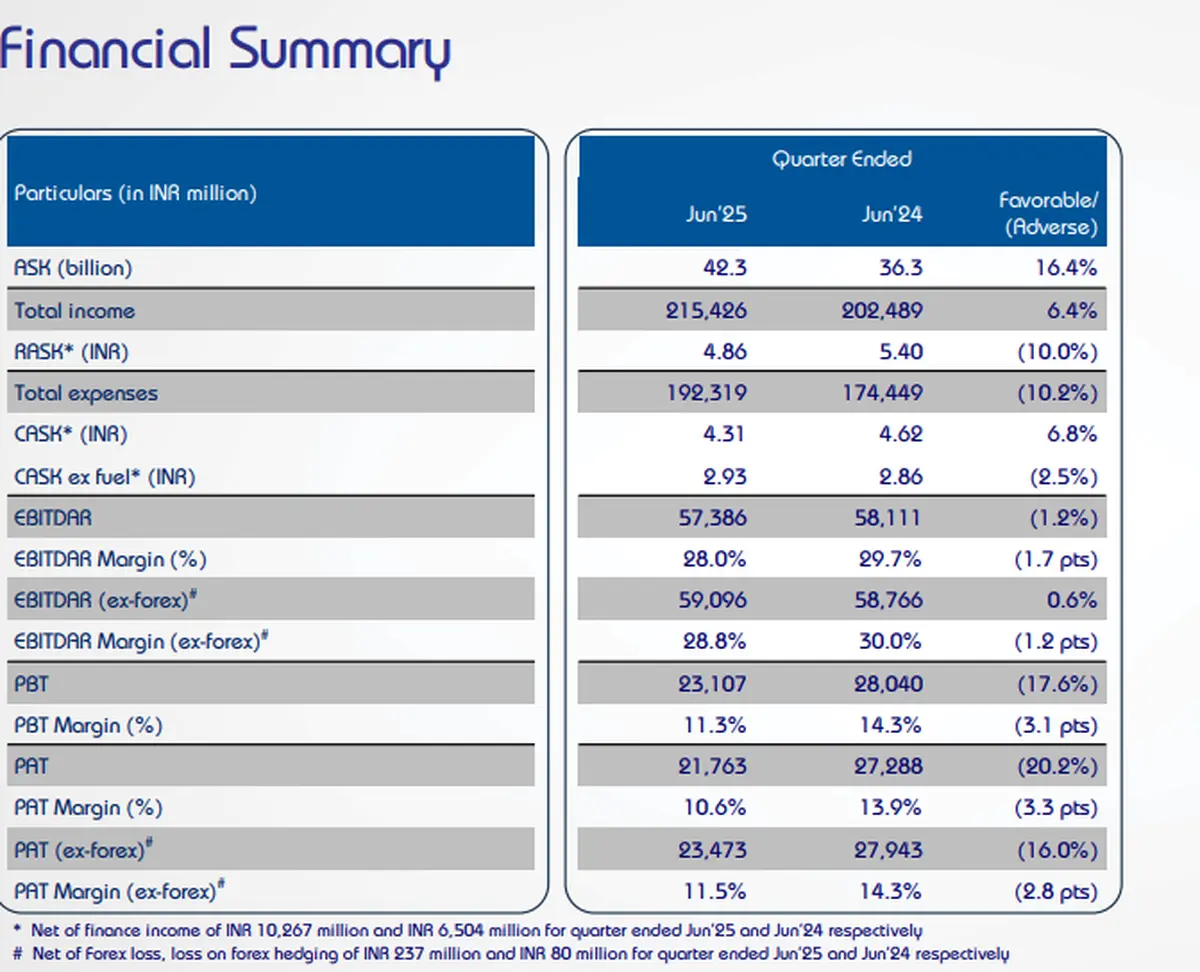

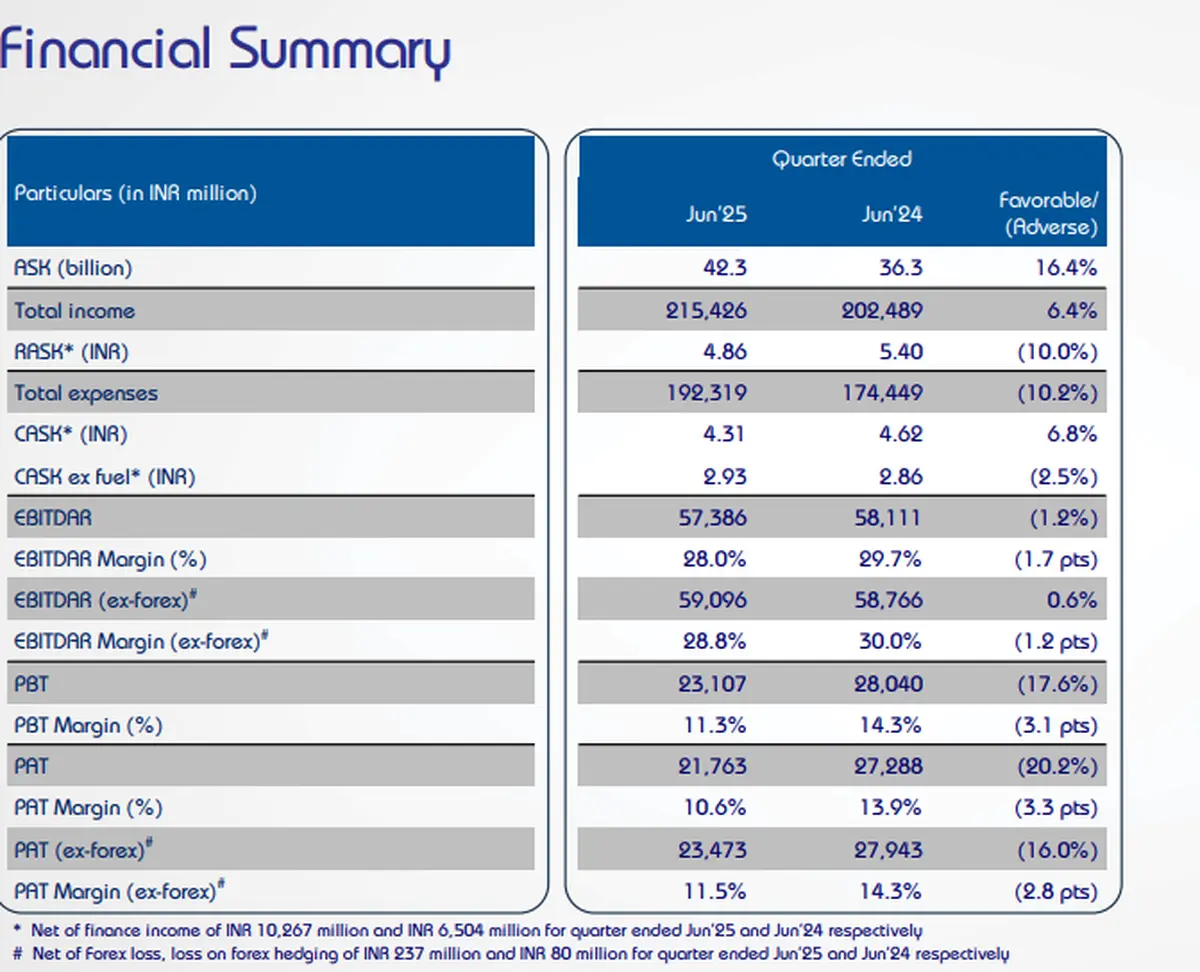

The broader Q2 Results 2025 season also saw announcements from other major players, including Mahindra & Mahindra, IndiGo, Paytm, Indian Hotels, and Berger Paints. While the overall trend indicates a cautious optimism, sectors linked to consumer demand and digital services are facing slower growth. Analysts believe that the ongoing festive quarter could offer a recovery opportunity for sectors like FMCG, hospitality, and technology.

Despite the uneven results, market sentiment remained largely stable, with investors focusing on long-term fundamentals. Experts noted that companies with diversified portfolios, efficient cost management, and digital adoption strategies are better positioned to weather short-term challenges. Also Read: India and New Zealand Launch Fourth Round of Trade Talks in Auckland: 2025

As the earnings season progresses, Q2 Results 2025 paint a clear picture of transformation within India’s corporate structure. Businesses are adapting to a new economic environment shaped by changing global trade patterns, domestic inflation control measures, and evolving consumer preferences.

Conclusion:

Q2 Results 2025 underscore both the resilience and volatility of India’s corporate sector. While giants like Adani Enterprises, SBI, and Suzlon Energy posted strong profits, others faced margin pressures due to rising costs and demand fluctuations. The quarter highlights the growing divergence between sectors, emphasizing the need for agility and innovation as key drivers for sustainable growth in the coming quarters.