Washington D.C. – The Tesla share price experienced a dramatic decline of more than 8% on Thursday following escalating tensions between US President Donald Trump and Tesla CEO Elon Musk over the controversial US tax bill. This significant drop in Tesla share price has sent shockwaves through the investment community, highlighting how political relationships can directly impact major corporations and their market valuations.

The conflict centers around Trump’s sweeping tax-cut and spending legislation, which Musk has publicly opposed with unprecedented intensity. The Tesla share price decline reflects investor concerns about the deteriorating relationship between the world’s richest man and the US President, particularly given Musk’s previous close ties to the Trump administration through his role in the Department of Government Efficiency.

Steep Decline Continues Year-Long Trend

The recent Tesla share price drop represents the continuation of a troubling trend that has persisted since late last year. Tesla shares have shed approximately 20% in just the last five days, contributing to a staggering year-to-date decline of nearly 30%. This sustained pressure on Tesla share price has erased significant value from the electric vehicle manufacturer’s market capitalization.

Thursday’s dramatic fall in Tesla share price wiped out nearly $150 billion from Tesla’s market value, representing one of the most significant single-day losses in the company’s history. This massive reduction in Tesla share price partially reversed the substantial gains the stock had experienced over the previous eight weeks, when optimism surrounding Tesla’s autonomous vehicle initiatives had driven investor enthusiasm.

Also Read: Trump Travel Ban Shocks World: 12 Countries Face Complete Entry Restrictions

Trump’s Disappointment and Public Criticism

President Trump expressed his disappointment with Musk during an Oval Office statement, directly addressing their deteriorating relationship and its potential impact on Tesla share price. Trump stated, “Look, Elon and I had a great relationship. I don’t know if we will anymore,” indicating that the personal and professional relationship between the two prominent figures has reached a critical juncture that investors fear could further pressure Tesla share price.

The President’s comments suggest that the conflict extends beyond policy disagreements to personal disappointment, creating uncertainty about future interactions that could continue to influence Tesla share price movements. Trump acknowledged that Musk had previously spoken positively about him but expressed concern about the trajectory of their relationship and its potential implications.

Tax Bill Controversy at the Heart of Dispute

The core of the dispute revolves around Trump’s comprehensive tax and spending bill, which Musk has characterized as a “disgusting abomination.” The Tesla share price decline appears directly linked to investor concerns about how this legislative battle might affect Tesla’s business operations, particularly regarding electric vehicle tax incentives that have historically supported the company’s growth.

Trump alleged that Musk’s opposition stems from provisions in the bill that would eliminate consumer tax credits for electric vehicles, potentially impacting Tesla’s competitive position and future sales prospects. This connection between policy changes and Tesla share price performance demonstrates how regulatory environments can significantly influence individual stock valuations in the electric vehicle sector.

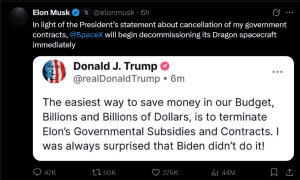

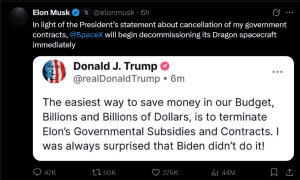

Musk’s Response and Social Media Activity

Musk responded to Trump’s criticism through his social media platform X, disputing the President’s claims and defending his position on the tax legislation. The public nature of this exchange has added another layer of uncertainty for investors monitoring Tesla share price movements, as social media disputes between high-profile figures can create additional volatility in stock markets.

The Tesla CEO’s continued criticism of the bill, despite potential negative impacts on Tesla share price, suggests his commitment to his stated fiscal concerns outweighs immediate market considerations. This stance has created a complex dynamic where Musk’s public positions may continue to influence Tesla share price performance regardless of Tesla’s operational fundamentals.

Department of Government Efficiency Transition

The timing of this dispute coincides with Musk’s recent transition away from his leadership role in the Department of Government Efficiency (DOGE), where he had been spearheading cost-cutting initiatives for the federal government. This transition, combined with the current controversy, creates additional uncertainty about Musk’s future relationship with the Trump administration and potential implications for Tesla share price.

Investors had previously viewed Musk’s government role as potentially beneficial for Tesla’s regulatory environment, making the current conflict particularly concerning for Tesla share price prospects. The end of this collaborative relationship removes a potential source of policy support that some investors may have factored into their Tesla valuations.

Market Value Impact and Investor Concerns

The $150 billion reduction in Tesla’s market value represents a significant wealth destruction event that has affected both institutional and individual investors. This dramatic impact on Tesla share price demonstrates how quickly market sentiment can shift when corporate leaders become involved in high-profile political disputes.

The magnitude of the Tesla share price decline suggests that investors are pricing in potential long-term consequences of the Trump-Musk feud, rather than viewing it as a temporary disagreement. This sustained pressure on Tesla share price indicates that market participants believe the conflict could have lasting implications for Tesla’s business environment and growth prospects.

Future Implications for Tesla

The ongoing dispute between Trump and Musk creates an uncertain environment for Tesla share price recovery, particularly as the tax bill remains under consideration in Congress. The resolution of this political conflict, along with any potential changes to electric vehicle incentives, will likely continue to influence Tesla share price movements in the coming weeks and months.

The Tesla share price performance during this period will serve as a critical indicator of how successfully the company can navigate political uncertainties while maintaining its competitive position in the rapidly evolving electric vehicle market.