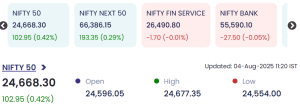

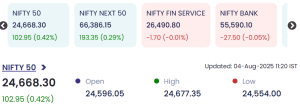

Mumbai, 4 August 2025 – Indian equity markets began the week on a firm note as the Nifty 50 index advanced by 0.42%, settling at 24,668.30 on Monday. The broader market sentiment remained cautiously optimistic amid global economic cues, domestic earnings reports, and continued institutional activity.

Also Read: August 1, 2025 : Nifty 50 Ends in Red; Broader Markets Extend Losses Amid Profit Booking

Top Gainers

Other notable gainers included:

-

NSIL – showing steady buying interest in diversified investments.

-

IIFLSEC – supported by robust financial services demand.

-

BHAGCHEM – rising on the back of improved operational guidance.

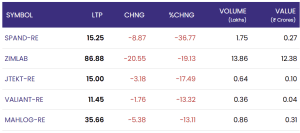

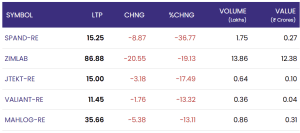

Top Losers

Additional laggards included:

-

KALYANKJIL – impacted by margin compression in the retail jewelry space.

-

IIFL – reacting to regulatory commentary.

-

EPL – seeing a correction post its recent rally.

Broader Market and Sectoral View

The Nifty Next 50 index also ended in the green, suggesting broader participation beyond blue-chip counters. While banking and financial stocks traded in a narrow range, infrastructure, metals, and realty sectors saw increased traction.

Market breadth remained positive, with more stocks advancing than declining on both the NSE and BSE. Trading volumes were healthy, with institutional and retail activity concentrated in key momentum stocks.

Analyst Commentary on 4 August 2025

Market analysts attribute the positive closing to sustained interest in select mid-cap and growth-oriented stocks. “The market is navigating global macro headwinds well, with investor focus now shifting to domestic economic indicators and policy support in infrastructure and manufacturing,” said Ananya Desai, Senior Equity Strategist at Axis Securities.

However, experts also cautioned against overexuberance, citing potential volatility due to global interest rate movements and upcoming U.S. economic data.

Outlook

With corporate earnings season underway and stable domestic fundamentals, markets are expected to stay range-bound with a positive bias. Focus will remain on global inflation cues, FII flows, and policy announcements.